The state government established a capital project fund in 2016 to build new highways. The fund is

Question:

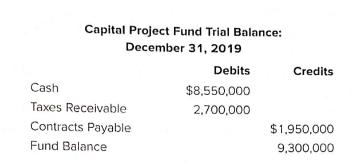

The state government established a capital project fund in 2016 to build new highways. The fund is supported by a 5 percent tax on diesel fuel sales in the state. The tax is collected by private gas stations and remitted in the following month to the State. The following transactions occurred during 2020:

1. $2,100,000 of encumbrances outstanding at December 31, 2019, were re-established.

2. During the year, fuel taxes were remitted to the State totaling $23,600,000, including the amount due at the end of the previous year. In addition, $2,870,000 is expected to be remitted in January of next year for fuel sales in December 2020.

3. The State awarded new contracts for road construction totaling $23,650,000.

4. During the year, contractors submitted invoices for payment totaling $23,650,000. These were all under the terms of contracts (i.e., same $amounts) issued by the State.

5. The State made payments on outstanding accounts of $23,375,000. The state government operates a debt service fund to service outstanding general obligation bonds. The following transactions occurred during 2020:

6. The state General Fund provided cash of $4,850,000 through transfer to the debt service fund.

7. Payments for matured interest totaled $2,985,000 and payments for matured principal totaled $1,850,000 during the year.

8. In December, the State refunded bonds to obtain a better interest rate. New bonds were issued providing proceeds of $25,000,000, which was immediately used to retire outstanding bonds in the same amount.

Step by Step Answer:

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley