Bottle-Up, Inc., was organized on January 8, 2010, and made its S election on January 24, 2010.

Question:

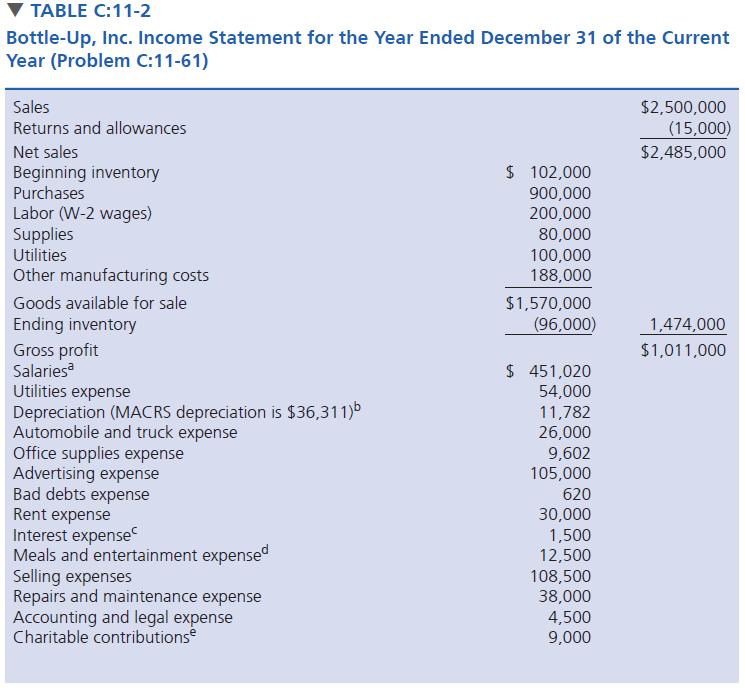

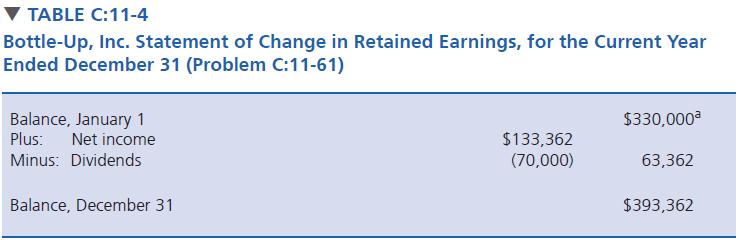

Bottle-Up, Inc., was organized on January 8, 2010, and made its S election on January 24, 2010. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up’s single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Prepare a 2019 S corporation tax return for Bottle-Up, showing yourself as the paid preparer.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse