Gabriel Corporation is owned 90% by Zeier Corporation and 10% by Ray Goff, a Gabriel employee. A

Question:

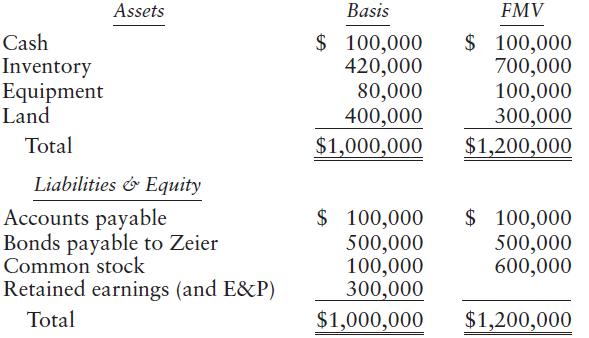

Gabriel Corporation is owned 90% by Zeier Corporation and 10% by Ray Goff, a Gabriel employee. A preliquidation balance sheet for Gabriel is presented below:

Gabriel has claimed $150,000 of MACRS depreciation on the equipment. Gabriel purchased the land three years ago as a potential plant site. Plans to build the plant never were consummated, and Gabriel has held the land since then as an investment. Zeier and Ray Goff have $90,000 and $10,000 bases, respectively, in their Gabriel stock. Both shareholders have held their stock since the corporation’s inception ten years ago. Gabriel adopts a plan of liquidation. Gabriel transfers $500,000 of inventory to Zeier to retire the bonds. The shareholders receive their share of Gabriel’s remaining assets and assume their share of Gabriel’s liabilities (other than federal income taxes). Gabriel pays federal income taxes owed on the liquidation. Assume a 21% corporate tax rate. What are the tax consequences of the liquidation to Ray Goff, Zeier Corporation, and Gabriel Corporation?

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse