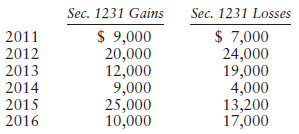

Consider the following summary of Sec. 1231 gains and losses recognized by Janet during the period 20112016.

Question:

Transcribed Image Text:

Sec. 1231 Gains Sec. 1231 Losses $ 9,000 20,000 12,000 9,000 25,000 10,000 $ 7,000 24,000 19,000 4,000 13,200 17,000 2011 2012 2013 2014 2015 2016

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

2011 2000 NLTCG 2012 Zero 4000 ordinary loss 2013 Zero 7000 ordinary los...View the full answer

Answered By

Muhammad Salman Alvi

Well, I am a student of Electrical Engineeing from Information Technology University of Punjab. Just getting into my final year. I have always been good at doing Mathematics, Physics, hardware and technical subjects. Teaching profession requires a alot of responsibilities and challenges.

My teaching experience started as an home tutor a year ago. When I started teaching mathematics and physic subjects to an O Level student. He was about 14 years old. His name was Ibrahim and I used to teach him for about 2 hours daily. Teaching him required a lot of patience but I had to be polite with him. I used to give him a 5 min break after 1 hour session. He was quite weak in basic maths and calculation. He used to do quite a lot of mistakes in his homework which I gave him weekly. So I decided to teach him basics from scratch. He used to say that he got the concept even if he didn't. So I had to ask him again and again. I worked on his basics for a month and after that I started taking a weekly test sesions. After few months he started to improve gradually. Now after teaching him for about a year I can proudly say that he has improved alot. The most important thing was he managed to communicate all the difficullties he was facing. He was quite capable and patient. I had a sincere desire to help him reach to its full potential. So I managed to do that. We had a very good honest relationship of a student and a teacher. I loved teaching him as a tutor. Now having an experience of one year teaching I can read students quite well. I look forward to work as an online tutor who could help students in solving their all sort of difficulties, problems and queries.

4.90+

29+ Reviews

43+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Consider the follo,ving summary of Sec. 1231 gains and losses recognized by Janet during the period 2013- 2018. Janet had no nonrecaptured Sec. 1231 losses at the beginning of 2013. If Janet has no...

-

The following summary of the earnings per share (in U.S. $), price-earnings (P-E), payout, and dividend yield ratios is available for five years ended December 31 for Barrick Gold Corporation:...

-

The following summary of the earnings per share, price-earnings (P-E), payout, and dividend yield ratios is available for five years ended December 31 for TransAlta Corporation: Instructions (a) What...

-

The magnet has mass 3 . 8 5 kg and the force pulling it to the right is 1 3 6 . 8 N . When the magnet hits the floor, it continues being pulled to the right by the same magnetic force as before. The...

-

National power is the sum of the capabilities of a country to implement successfully its foreign policy, even when policies are opposed by other states or need the cooperation of other states. Power...

-

A particle moves along the x axis. Its position is given by the equation x = 2 x 3t - 4t2 with x in meters and t in seconds. Determine (a) Its position when it changes direction and (b) Its velocity...

-

A \(5-\mathrm{kg}\) object is subject to an interaction that has a potential energy \(U(x)=\frac{1}{2} k x^{2}-b x\), where \(k=2.0 \mathrm{~J} / \mathrm{m}^{2}\) and \(b=1.5 \mathrm{~J} /...

-

Vegan, LLC, owns a chain of gourmet vegetarian take-out markets. Last month, Store P generated the following information: sales, $890,000; direct materials, $220,000; direct labor, $97,000; variable...

-

4. 5. A heavy particle is projected with a velocity at an angle with the horizontal into the uniform gravitational field. The slope of the trajectory of the particle varies with its horizontal...

-

You discover with dismay that, because of the tight economic climate, your company has instituted a wage freeze. Your performance during the year has been outstanding and you have made a worthwhile...

-

Suppose you are a family protective services caseworker employed by the county government. You have been asked to investigate a case of possible elder abuse. Mamie is 87, is slowly losing her memory...

-

What historical and statistical factors suggest racial discrimination in the administration of the death penalty in this country? What reform has been instituted at the federal level to try to combat...

-

Write a function to add two sparse matrices as represented in Section 12.2. 12.2 Matrix Representations Some applications must represent a large, two-dimensional matrix where many of the elements...

-

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%....

-

1. A train traveling at a constant speed of 26.8 m/s rounds a curve of radius 255 m. A chandelier suspended from the ceiling swings out an angle 0 from the vertical throughout the turn. a. Draw the...

-

[a] Given the following data: xi Y; 1 1.25 1.5 1.75 5.10 N 5.79 6.53 7.45 8.46 Construct the least squares approximation of the form y-a ex, then find y(2.5). [b] Use best approximation for the first...

-

Based on the table suppose you have sold all 30 shares of WFC on February 1, 2022, and kept the proceeds in cash for the rest of the time period. Make the adjustment to the Portfolio returns...

-

Compute the Standard Deviation of the probaiblity weighted expected return of each sotck Stock A Case Base case Base case 15% Base case + 15% Stock B Case Base case Base case 20% Base case + 20%...

-

When disorder in a system increases, does entropy increase or decrease?

-

For a nonzero constant a, find the intercepts of the graph of (x 2 + y 2 ) 2 = a 2 (x 2 - y 2 ). Then test for symmetry with respect to the x-axis, the y-axis, and the origin.

-

Under Sec. 280A, how will a taxpayer report the income and expenses of a vacation home if it is rented out for only 12 days during the year?

-

David, a CPA for a large accounting firm, often works 10- to 12-hour days. As a requirement for his position, he must attend social events to recruit new clients. In addition to his job with the...

-

Gus, a football player who was renegotiating his contract with the Denver Broncos, paid his ex-girlfriend $50,000 to drop a sexual assault complaint against him and keep the matter confidential. The...

-

LaToya Limmons is the manager of the Human Resources (HR) department and Javier Jartin is the manager of the sales department for a production company headquartered in the United States but also has...

-

The beam AD is fixed to a rigid wall at A and is supported by props at B and C as shown in figure 1. In sections AB and BC, the flexural rigidity is EI, but in section CD the flexural rigidity is...

-

What is the meaning of 'framing' and how does it impact the way we negotiate? (Your own opinion)

Study smarter with the SolutionInn App