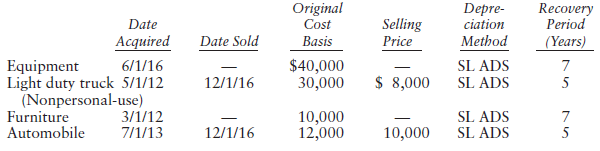

Long Corporation has been unprofitable for several years and has substantial NOL carryovers. Therefore, the company has

Question:

Long did not make the Sec. 179 election in any year, and elects out of bonus depreciation.

a. What is the depreciation deduction for each asset in 2016?

b. What amount of gain or loss does Long recognize on the properties sold in 2016?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: