You want to test the speed with which stock market prices adjust to positive earnings announcements. Company

Question:

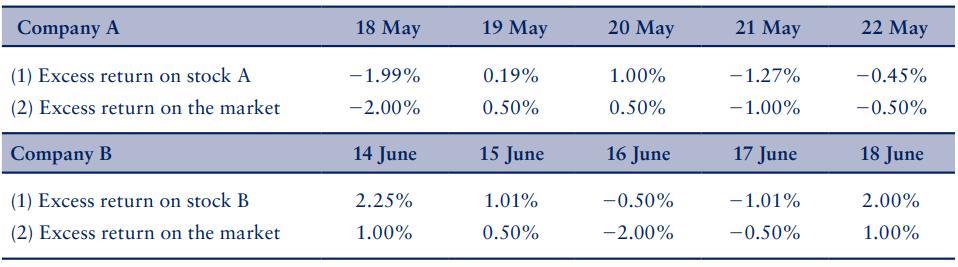

You want to test the speed with which stock market prices adjust to positive earnings’ announcements. Company A makes its earnings announcement on May 20 and Company B on June 16. You collected for each company daily share price returns two days before the event day and two days after the event day, as reported below. Company A has a beta of 1 and Company B a beta of 2.

a. Calculate the alphas of each company for each of the five days.

b. Calculate the average alphas of the two companies for each of the five days (note that in practice you will need to collect data for a larger number of companies to get reliable averages).

c. Calculate the cumulative average alphas from day one to day five.

d. Plot the cumulative average alphas on a graph similar to the one shown in Exhibit 3.17. Interpret the data: is the market informationally efficient or not?

Step by Step Answer:

Finance For Executives Managing For Value Creation

ISBN: 9781473749245

6th Edition

Authors: Gabriel Hawawini, Claude Viallet