Alphabet Inc. reported the following in note 14 to its 2018 10-K report: Income from continuing operations

Question:

Alphabet Inc. reported the following in note 14 to its 2018 10-K report:

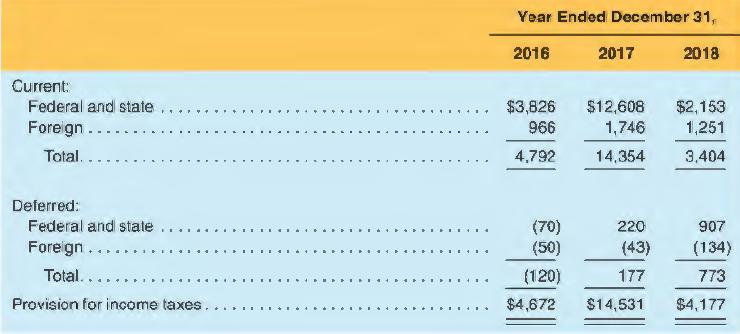

Income from continuing operations before income taxes included income from domestic operations of $12.0 billion, $10.7 billion, and $15.8 billion for the years ended December 31, 2016, 2017, and 2018, respectively, and income from foreign operations of $12.1 billion, $16.5 billion, and $19.1 billion for the years ended December 31, 2016, 2017, and 2018, respectively. The provision for income taxes consists of the following (in millions):

One-time transition tax

The Tax Act required us to pay U.S. income taxes on accumulated foreign subsidiary earnings not previously subject to U.S. income tax at a rate of 15.5% to the extent of foreign cash and certain other net current assets and 8% on the remaining earnings. We recorded a provisional amount for our one-time transitional tax liability and income tax expense of $10.2 billion as of December 31, 2017.

REQUIRED:

a. Compute Alphabet's effective tax rate for each year presented. Also, compute Alphabet's domestic tax rate (federal plus state) and its foreign tax rate on income from foreign operations.

b. How much did Alphabet record for the one-time transition tax related to the TCJA. How does this affect the income statement? The balance sheet?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman