Amazin, Inc. is a specialty online wholesaler that has just completed initial financing and acquired the physical

Question:

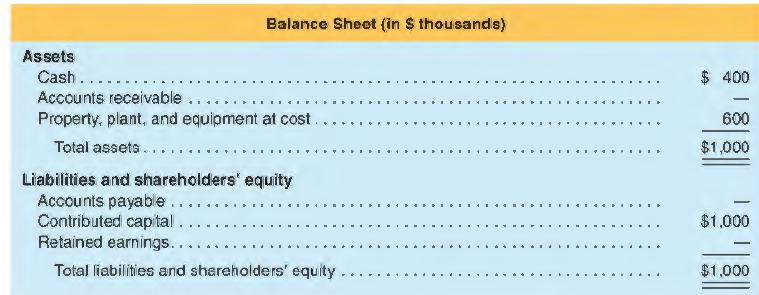

Amazin, Inc. is a specialty online wholesaler that has just completed initial financing and acquired the physical facilities to support its operation. The management team is optimistic about the company's growth opportunities as they begin operations. hut they also recognize that there arc significance risks for any young company's survival. The current financial condition is shown in the following balance sheet.

Amazin's management team has "benchmark" financial projections for the first quarter of operation. Revenue is forecasted to be $1,000 in QI. Cost of goods sold will be 40% of revenue, depreciation will be $75 for the quarter, and selling, general and administrative expenses (SG&A) will be 30% of revenue. This benchmark case is based on the assumption that customers will pay for purchases in the subsequent quarter, and Amazin, Inc. will be able to delay the payments to suppliers for the same length of time. Amazin's growth plans will require capital expenditures of $150 in QI and subsequent quarters. The dynamic nature of the company's operations means that these physical assets have a useful life of only eight quarters. The family and friends who funded the start-up are expecting dividends equal to 20% of profits. (Taxes may be ignored.)

REQUIRED:

a. Produce projected income statement, statement of cash flows, and ending balance sheet for Q1.

b. One team member suggests a more aggressive approach to growth. By increasing SG&A from 30% of revenue to 33%, revenue would increase from $1,000 to $1,200. What would be the effect of such a change on Amazin's income statement? On its cash flows and financial position?

c. One team member notes that suppliers are not going to be pleased to wait a quarter to be paid. Relative to the benchmark plan, he forecasts that cost of goods sold expense would be lower by 10% if suppliers were paid promptly. What would be the effect of such a change on Amazin's income statement? On its cash flows and financial position?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman