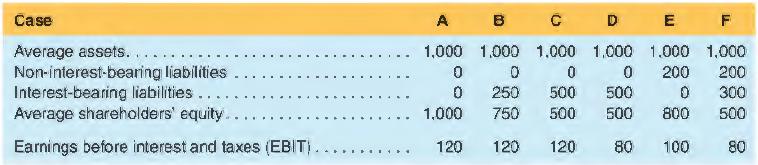

Basic income statement and balance sheet information is given below for six different cases. For each case,

Question:

Basic income statement and balance sheet information is given below for six different cases. For each case, the assets are financed with a mix of non-interest-bearing liabilities, 10% interest bearing liability and stockholders' equity. In all cases, the income tax rate is 40%.

a. For each case, calculate the return on equity (ROE), return on assets (ROA) and return on financial leverage (ROFL).

b. Consider cases A, B and C. How does increasing leverage affect the three ratios? Why does the ROE grow from case A to case C?

c. Consider cases C and D. When does leverage work in favor of shareholders? Does that hold for case E?

d. Case F has two types of liabilities. How does ROA compare to the rate on interest-bearing liabilities? Does leverage work in favor of the shareholders? Why?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman