Deere & Company reports the following tax information in its fiscal 2018 financial report. The provision for

Question:

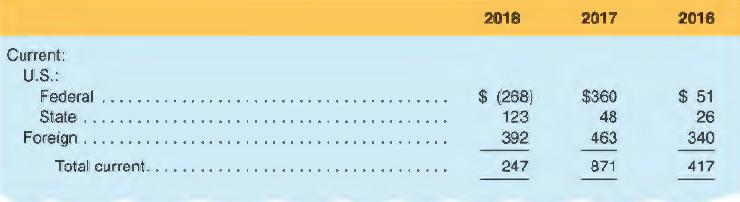

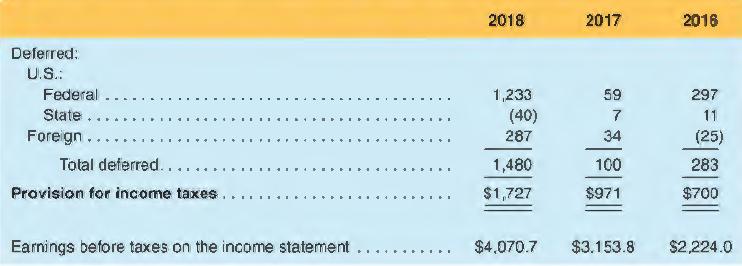

Deere & Company reports the following tax information in its fiscal 2018 financial report. The provision for income taxes by taxing jurisdiction and by significant component consisted of the following in millions of dollars:

REQUIRED:

a. What amount of tax expense is reported in Deere's 2018 income statement? In 2017? In 2016? How much of each year's income tax expense is current tax expense and how much is deferred tax expense?

b. Compute Deere's effective tax rate for each year.

c. Assume that Deere's deferred tax in 2018 is due to deferred tax liabilities. Provide one possible example that would be consistent with this situation.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman