General Mills, Inc. is a global consumer foods company. The firm manufactures and sells a wide range

Question:

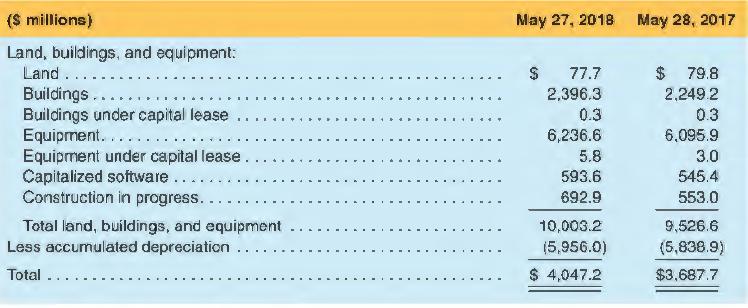

General Mills, Inc. is a global consumer foods company. The firm manufactures and sells a wide range of branded products and is a major supplier to the foodservice and baking industries. The company's core product areas are ready-to-eat cereal, super-premium ice cream, convenient meal solutions, and healthy snacking. The following data are taken from the company's 2018 annual report. From the balance sheet:

From the income statement ($ millions):

REQUIRED:

a. Compute the PPE turnover for 2018. Assuming an average PPE turnover of 4.0 for the company's closest competitors, does General Mills appear to be capital intensive?

b. Calculate the percentage depreciated of General Mills' depreciable assets at the end of fiscal year 2018. What implications might the result suggest for the company's future cash flows?

c. General Mills reports depreciation expense of approximately $589 million in 2018. Estimate the average useful life of its depreciable assets by dividing average depreciable assets by depreciation expense.

d. During 2018, General Mills purchased $622.7 million of land, buildings and equipment for cash. Create the necessary journal entries to reflect the asset purchases and the year's depreciation charge.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman