General Motors Corporation reported the following information in its 10-K report: The company reports its inventory using

Question:

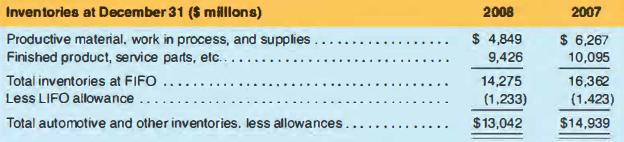

General Motors Corporation reported the following information in its 10-K report:

The company reports its inventory using the LIFO costing method during 2007 and 2008.

a. At what dollar amount are inventories reported on its 2008 balance sheet?

b. At what dollar amount would inventories have been reported in 2008 if FIFO inventory costing had been used?

c. What cumulative effect has the use of LIFO had, as of year-end 2008. on GM"s pretax income. compared to the pretax income that would have been reported using the FIFO costing method?

d. Assuming a 35% income tax rate, what is the cumulative effect on GM's tax liability as of year-end 2008?

e. In July 2009, GM changed its inventory accounting to FIFO costs. Why do you suppose GM made that choice?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman