Hoopes Corporation 's December 31, 2019, 10-K report has the following disclosures related to its retirement plans.

Question:

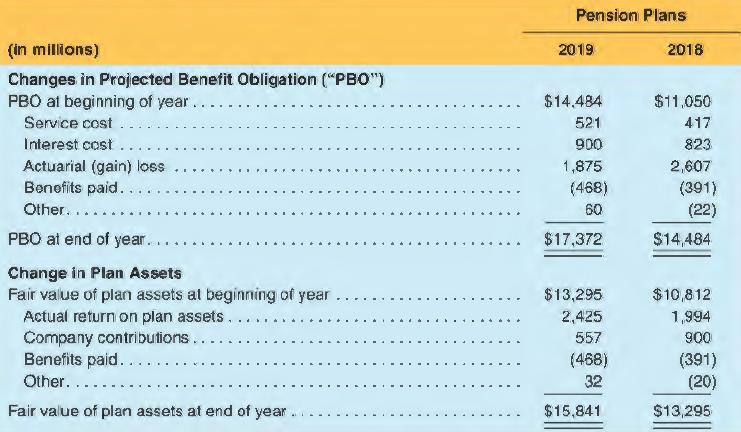

Hoopes Corporation 's December 31, 2019, 10-K report has the following disclosures related to its retirement plans. The following table provides a reconciliation of the changes in the pension plans' benefit obligations and fair value of assets over the two-year period ended December 31, 2019, and a statement of the funded status as of December 31, 2019 and 2018 (in millions):

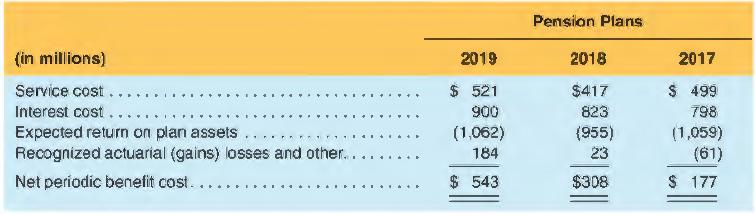

Net periodic benefit cost for the three years ended December 31 were as follows (in millions):

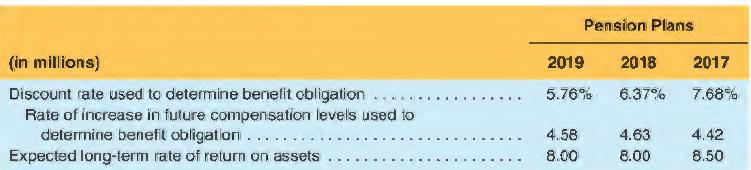

Weighted-average actuarial assumptions for our primary U.S. pension plans, which represent substantially all of our PBO, are as follows:

REQUIRED:

a. How much pension expense (revenue) does Hoopes report in its 2019 income statement?

b. Hoopes reports a $1,062 million expected return on plan assets as an offset to 2019 pension expense. Approximately, how is this amount computed? What is the actual gain or loss realized on its 2019 plan assets? What is the purpose of using this estimated amount instead of the actual gain or loss?

c. What factors affected its 2019 pension liability? What factors affected its 2019 plan assets?

d. What does the term funded status mean? What is the funded status of the 2019 Hoopes retirement plans? What amount of asset or liability does Hoopes report on its 2019 balance sheet relating to its retirement plans?

e. Hoopes decreased its discount rate from 6.37% to 5.76% in 2019. What effect(s) does this have on its balance sheet and its income statement?

f. Hoopes changed its estimate of expected annual wage increases used to determine its defined benefit obligation in 2019. What effect(s) does this change have on its financial statements? In general, how does such a change affect income?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman