Macy's, Inc., reported the following in its 2017 annual report: On December 22, 2017, H.R. 1 was

Question:

Macy's, Inc., reported the following in its 2017 annual report:

On December 22, 2017, H.R. 1 was enacted into law. This new tax legislation, among other things, reduced the U.S. federal corporate tax rate from 35% to 21% effective January 1, 2018.

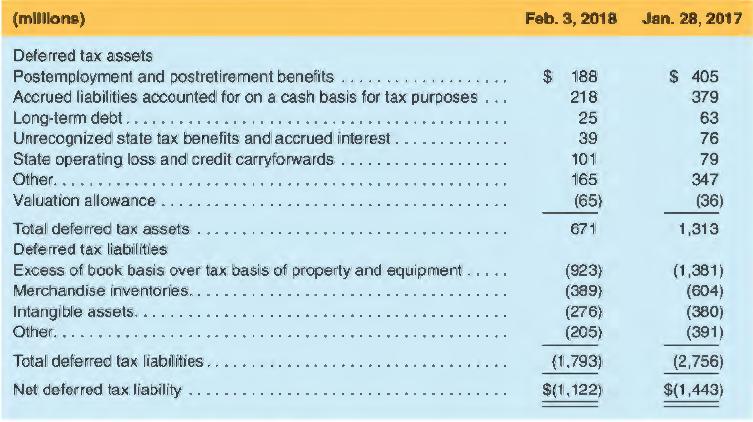

In applying the impacts of the new tax legislation to its 2017 income tax provision, the Company remeasured its deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future, which is generally a 21 % federal tax rate and its related impact on the state tax rates. The resulting impact was the recognition of an income tax benefit of $571 million in the fourth quarter of 2017. In addition, applying the new U.S. federal corporate tax rate of 21 % on January 1, 2018, resulted in a federal income tax statutory rate of 33.7% in 2017. Combining the impacts on the Company's current income tax provision and the re-measurement of its deferred tax balances, the Company's effective income tax rate was a benefit of 1.9% in 2017. The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities are as follows:

a. What was the amount of income tax expense or benefit that Macy's reported related to revaluing deferred tax assets and liabilities to the new, lower tax rate?

b. Explain why Macy's reported an income tax benefit when it revalued its deferred income tax liabilities and deferred income tax assets to the new, lower tax rate.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman