Refer to the Easton Company acquisition described in E12-42. Instead of a 100% acquisition, assume that Easton

Question:

Refer to the Easton Company acquisition described in E12-42. Instead of a 100% acquisition, assume that Easton purchased 40% of the outstanding shares of Harris Company on January I , 2019, for $156,000 in cash. Also assume that the undervalued buildings have an estimated remaining useful life of 20 years and the unrecorded patent has a useful life of 5 years. During 2019, Harris reported net income of $80,000 and paid cash dividends to shareholders totaling $40,000.

a. Prepare journal entries to record Easton Company's equity in the earnings of Harris Company, including any amortization of the excess of fair value over book value of assets acquired.

b. What is the value of the investment in Harris Company reported on Easton Company's balance sheet as of December 31, 2019?

Data from E12-42:

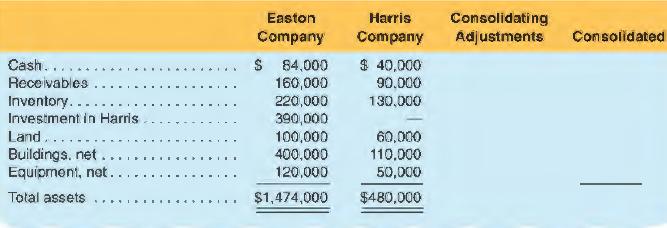

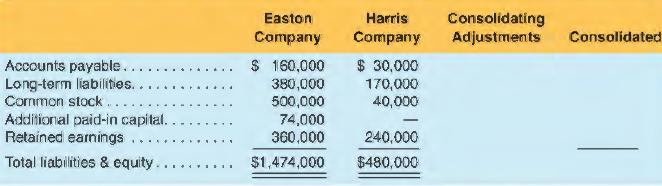

Easton Company acquires 100% of the outstanding voting shares of Harris Company on January 1, 2019. To obtain these shares, Easton pays $210,000 in cash and issues 5,000 of its $10 par value common stock. On this date, Easton's stock has a fair value of $36 per share, and Harris's book value of stockholders' equity is $280,000. Easton is willing to pay $390,000 for a company with a book value for equity of $280,000 because it believes that (1) Harris buildings are undervalued by $40,000, and (2) Harris has an unrecorded patent that Easton values at $30,000. Easton considers the remaining balance sheet items to be fairly valued (no book-to-fair value difference). The remaining $40,000 of the purchase price excess over book value is ascribed to corporate synergies and other general unidentifiable intangible assets (goodwill). The January 1, 2019, balance sheets at the acquisition date follow:

a. Show the breakdown of the investment into the book value acquired, the excess of fair value over book value, and the portion of the investment representing goodwill.

b. Prepare the consolidating adjustments and the consolidated balance sheet. Identify the adjustments by whether they relate to the elimination of stockholders' equity [S] or the excess of purchase price over book value [A].

c. How will the excess of the purchase price over book value acquired be treated in years subsequent to the acquisition?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman