Sarah Penney operates the Wildlife Picture Gallery, selling original art and signed prints received on consignment (rather

Question:

Sarah Penney operates the Wildlife Picture Gallery, selling original art and signed prints received on consignment (rather than purchased) from recognized wildlife artists throughout the country.

The firm receives a 30% commission on all art sold and remits 70% of the sales price to the artists. All art is sold on a strictly cash basis.

Sarah began the business on March1, 2019. The business received a $10,000 loan from a relative of Sarah to help her gel started; it took on a note payable agreeing to pay the loan back in one year. No interest is being charged on the loan, but the relative does want to receive a set of financial statements each month. On April 1, 2019, Sarah asks for your help in preparing the statements for the first month.

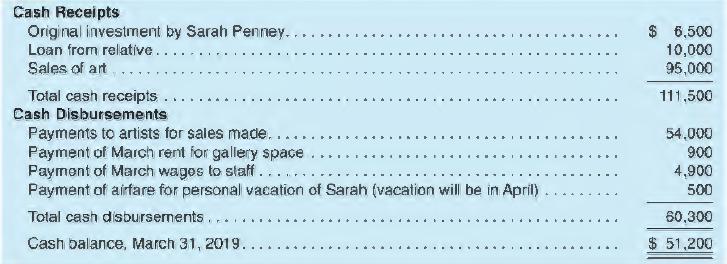

Sarah has carefully kept the firm's checking account up to date and provides you with the following complete listing of the cash receipts and cash disbursements for March 2019.

Sarah also gives you the following documents she has received:

1. A $350 invoice for March utilities; payment is due by April 15, 2019.

2. A $1,700 invoice from Careful Express for the shipping of artwork sold in March; payment is due by April 10, 2019.

3. Sarah signed a one-year lease for the gallery space; as an incentive to sign the lease, the landlord reduced the first month's rent by 25%; the monthly rent starting in April is $1,200. In your discussions with Sarah, she tells you that she has been so busy that she is behind in sending artists their share of the sales proceeds. She plans to catch up within the next week.

REQUIRED:

From the above information, prepare the following financial statements for Wildlife Picture Gallery: (a) income statement for the month of March 2019; (b) statement of stockholders' equity for the month of March 2019; and (c) balance sheet as of March 31, 2019.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman