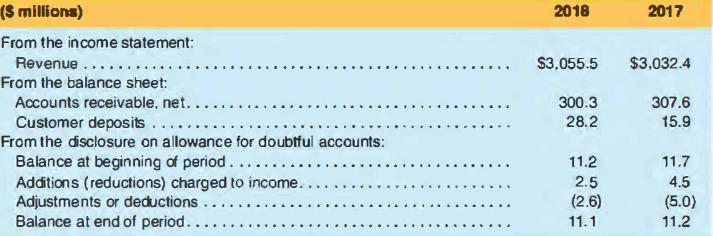

Steelcase, Inc. reported the following amounts in its 2018 and 2017 10-K reports (years ended February 23,

Question:

Steelcase, Inc. reported the following amounts in its 2018 and 2017 10-K reports (years ended February 23, 2018. and February 24, 2017).

a. Prepare the journal entry to record accounts receivable written off as uncollectible in 2018. Also prepare the entry to record the provision for doubtful accounts (bad debts expense) for 2018. What effect did these entries have on Steelcase's income for that year?

b. Calculate Steelcase 's gross receivables for the years given, and then determine the allowance for doubtful accounts as a percentage of the gross receivables.

c. Calculate Steelcase 's accounts receivable turnover for 2018. (Use Accounts receivable, net for the calculation.)

d. How much cash did Steelcase receive from customers in 2018?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman