Target Corporation disclosed the following in the notes to their 2018 10-K. Leases: We adopted ASU No.

Question:

Target Corporation disclosed the following in the notes to their 2018 10-K.

Leases:

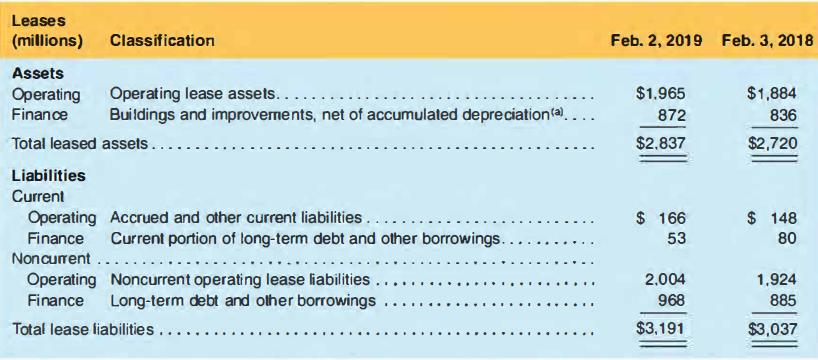

We adopted ASU No. 2016-02-Leases (Topic 842), as amended, as of February 4, 2018, using the modified retrospective approach. The modified retrospective approach provides a method for recording existing leases at adoption and in comparative periods that approximates the results of a full retrospective approach. In addition, we elected the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allowed us to carry forward the historical lease classification. We also elected the practical expedient related to land easements, allowing us to carry forward our accounting treatment for land easements on existing agreements.

Adoption of the new standard resulted in the recording of additional net lease assets and lease liabilities of approximately $1.3 billion and $1.4 billion respectively, as of February 4, 2018. The difference between the additional lease assets and lease liabilities, net of the deferred tax impact, was recorded as an adjustment to retained earnings. The standard did not materially impact our consolidated net earnings and had no impact on cash flows.

(a) Finance lease assets are recorded net of accumulated amortization of $371 million and $317 million as of February 2, 2019 and February 3, 2018, respectively. (a) Includes short-term leases and variable lease costs, which are immaterial.

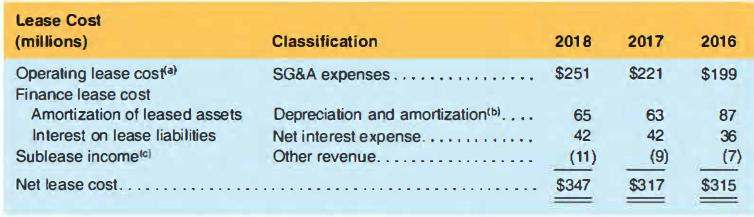

(a) Includes short-term leases and variable lease costs, which are immaterial.

(b) Supply chain-related amounts are included in Cost of Sales.

(c) Sublease income excludes rental income from owned properties of $47 million for 2018, 2017, and 2016, which is included in Other Revenue.

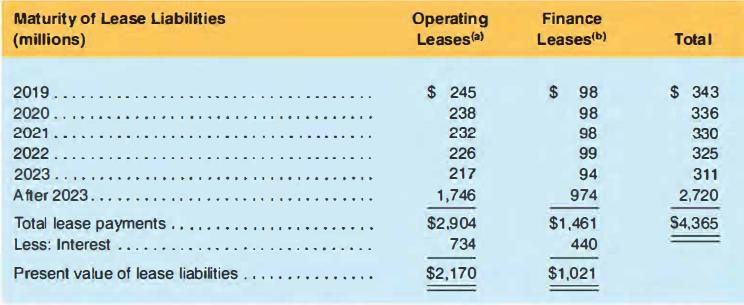

(a) Operating lease payments include $778 million related to options to extend lease terms that are reasonably certain of being exercised and exclude $341 million of legally binding minimum lease payments for leases signed but not yet commenced.

(b) Finance lease payments include $127 million related to options to extend lease terms that are reasonably certain of being exercised and exclude S1 93 million of legally binding minimum lease payments for leases signed but not yet commenced.

a. What is the right-of-use asset for operating leases as of the end of fiscal 2018?

b. What is the net asset recorded for finance leases at the end of fiscal 2018?

c. What is the lease liability balance for operating leases as of the end of fiscal 2018? What does this amount represent?

d. What is the amount of amortization expense recorded in 2018 for finance leases?

e. What is the amount of interest expense recorded in 2018 for finance leases?

f. What is recorded on the income statement for operating leases?

g. Assume the lease payment for 2018 for finance leases is $125 million. Record the entries for 2018 (year ended February 2, 2019) for finance leases.

h. Discuss the implications of the different line items on the income statement for expensing lease costs for both types of leases that Target discloses.

i. Target has reported total assets for 2018 (year ended February 2, 2019) of $41,290, total liabilities of $29,993, and equity of $11,297. Explain the effect on debt-to-equity from having the operating leases "on-balance sheet."

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman