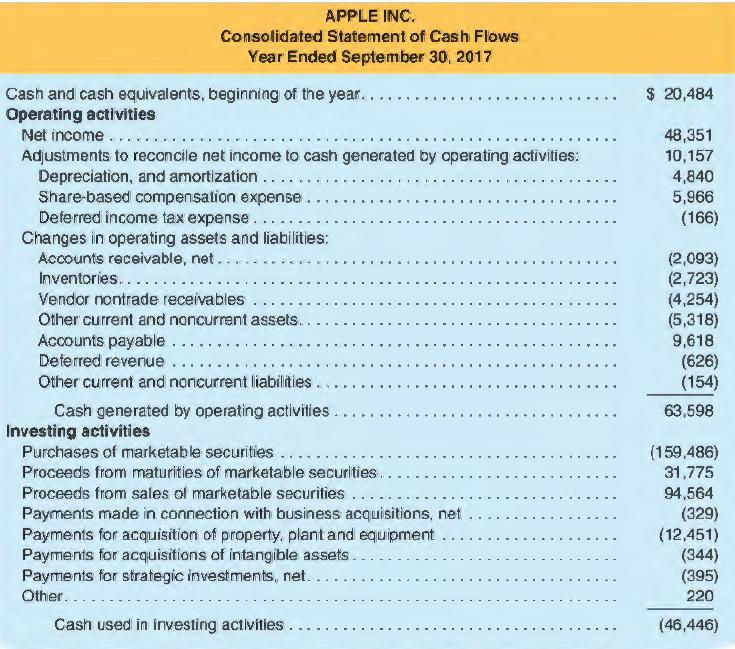

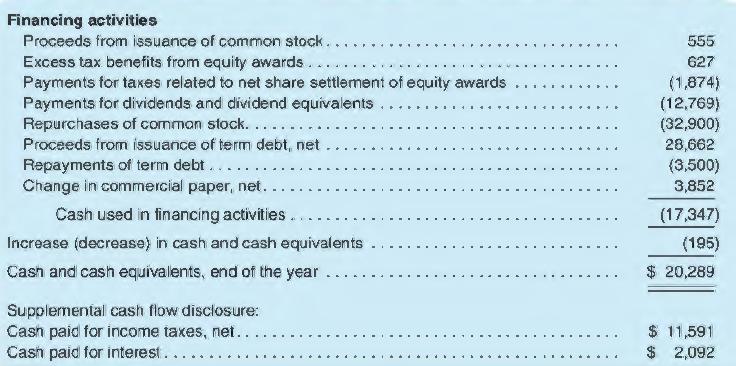

The 2017 cash flow statement for Apple Inc. is presented below (all $ amounts in millions): REQUIRED:

Question:

The 2017 cash flow statement for Apple Inc. is presented below (all $ amounts in millions):

REQUIRED:

a. Did Apple's accounts receivable go up or down in 2017? Apple reported net sales of $229,234 in its fiscal 2017 income statement. What amount of cash did Apple collect from customers during the year? ( Ignore the Vendor nontrade receivables account, which relates to Apple's suppliers.)

b. Apple's cost of goods sold was $141,048 million in 2017. Assuming that accounts payable applies only to the purchase of inventory, what amount did Apple pay to purchase inventory in 2017?

c. At September 30, 2017, Apple reported a balance of $33.8 billion in property, plant, and equipment, net of accumulated depreciation, and its footnotes revealed that depreciation expense on property, plant, and equipment was $8.2 billion for fiscal 2017. What was the balance in property, plant, and equipment, net of accumulated depreciation at the end of fiscal 2016?

d. Apple lists stock-based compensation as a positive amount-$4,840 million-under cash flow from operating activities. Why is this amount listed here? Explain how this amount increases cash flow from operating activities.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman