The following footnote is from Note 8 to the 2018 10-K of Tesla, Inc.: Note &-Property, Plant

Question:

The following footnote is from Note 8 to the 2018 10-K of Tesla, Inc.:

Note &-Property, Plant and Equipment:

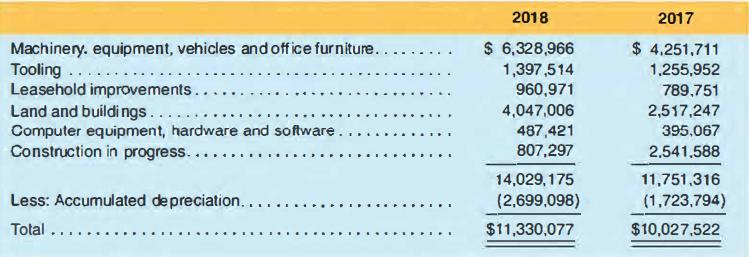

Our property, plant and equipment, net, consisted of the following (in thousands):

The summary of significant accounting policies included the following description of Tesla's depreciation policies:

Property, plant and equipment, including leasehold improvements, are recognized at cost less accumulated depreciation. Depreciation is generally computed using the straight-line method over the estimated useful lives of the respective assets, as follows:

Machinery, equipment, vehicles and office furniture ................. 2 to 12 years

Building and building improvements. ............................................ 15 to 30 years

Computer equipment and software ............................................... 3 to 10 years

Depreciation for tooling is computed using the units-of-production method whereby capitalized costs are amortized over the total estimated productive life of the respective assets. As of December 31, 2018. the estimated productive life for Model S and Model X tooling was 325,000 vehicles based on our current estimates of production. As of December 31, 2018, the estimated productive life for Model 3 tooling was 1,000,000 vehicles based on our current estimates of production.

1. Tesla's revenue totaled $21,461,268 ($ thousands) in 2018. Compute its PPE turnover for the year.

2. Compute the percent depreciated ratio for 2018.

3. Comment on these ratios. What effect does Tesla's depreciation policies have on these ratios?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman