The following information is taken from Williams-Sonoma, lnc.'s 10-K . Note D: Income Taxes The components of

Question:

The following information is taken from Williams-Sonoma, lnc.'s 10-K .

Note D: Income Taxes

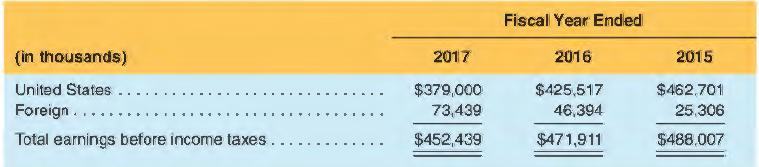

The components of earnings before income taxes, by tax jurisdiction, are as follows:

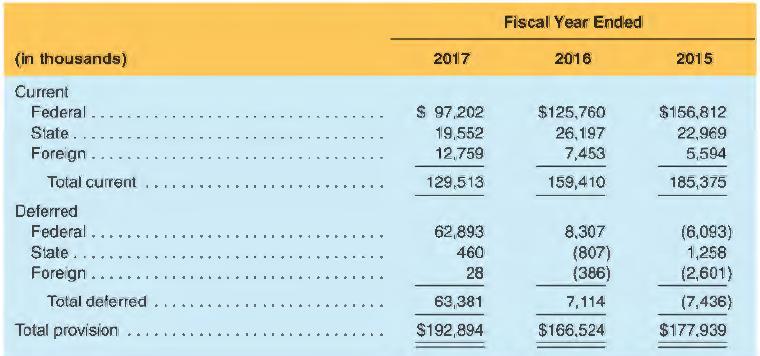

The provision for income taxes consists of the following:

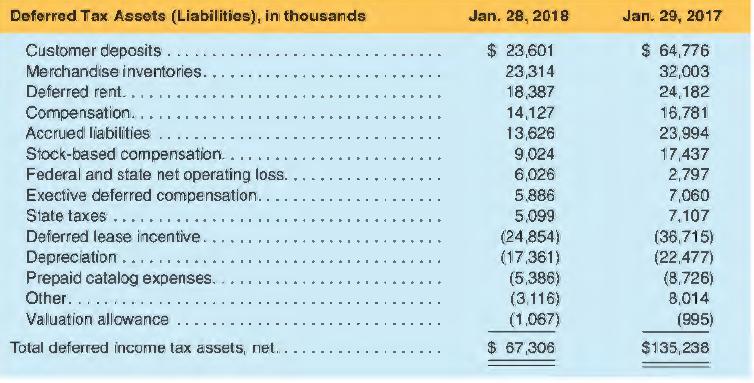

We have historically elected not to provide for U.S. income taxes with respect to the undistributed earnings of our foreign subsidiaries as we intended to utilize those earnings in our foreign operations for an indefinite period of time. As a result of the Tax Act, we are deemed to have remitted all of the post-1986 accumulated earnings of our foreign subsidiaries to the U.S. as of December 31 , 2017 as part of the transition tax . . . . In light of the Tax Act, we continue to evaluate our permanent reinvestment assertion and expect our evaluation of the impact to be completed within the one-year measurement period under SAB 118. Our U.S. federal statutory rate for fiscal 2017 was a blended rate of 33.9%, and our rate will be 21% for future fiscal years. Based on information available as of January 28, 2018, we recorded a net tax expense of $13,200,000 for the transition tax and $28,300,000 for the remeasurement of our deferred tax assets.

REQUIRED:

a. What amount of income tax expense did Williams-Sonoma report for the year ended January 28, 2018?

b. Calculate Williams-Sonoma's effective tax rate for each year reported. In addition, calculate the rate of U.S. federal taxes on U.S. income in the fiscal year ended January 28, 2018.

c. Williams-Sonoma reported income taxes payable of $56,783 thousand in its January 28, 2018, balance sheet, and $23,245 thousand at January 29, 2017. What amount of income taxes did it pay in cash during the fiscal year ended January 28, 2018?15

d. Prepare a journal entry to record income tax expense for the fiscal year ended January 28, 2018.

e. The company reported a net book value of property, plant, and equipment of $932,283 thousand on January 28, 2018. Given a tax rate of 21 % (assume they are all in the U.S.), what is an estimate of the tax basis of these assets on that date?

f. The company reported prepaid catalog expense of $58,693 thousand as a current asset in its January 28, 2018, balance sheet. The company provided the following explanation of this asset in the footnotes to its 10-K:

Advertising and Prepaid Catalog Expenses:

Advertising expenses consist of media and production costs related to catalog mailings, e-commerce advertising and other direct marketing activities. All advertising costs are expensed as incurred, or upon the release of the initial advertisement, with the exception of prepaid catalog expenses. Prepaid catalog expenses consist primarily of third party incremental direct costs, including creative design, paper, printing, postage and mailing costs for all of our direct response catalogs. Such costs are capitalized as prepaid catalog expenses and are amortized over their expected period of future benefit. Each catalog is generally fully amortized over a six to nine month period, with the majority of the amortization occurring within the first four to five months. Explain how this expense results in a temporary difference between tax and financial reporting.

g. What does Williams-Sonoma say they have accrued for the TCJA Transition Tax? How did this amount affect income tax expense?

h. Williams-Sonoma has a valuation allowance listed in its schedule of deferred tax assets and liabilities. Briefly and in general explain what a valuation allowance is and how it affects deferred taxes and reported income.

i. Williams-Sonoma states that the company recorded a $28.3 million additional tax expense for the re-measurement of deferred tax assets. Explain what this is and why the company had to record this expense.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman