The president and CFO of Lambert Co. will be meeting with their bankers next week to discuss

Question:

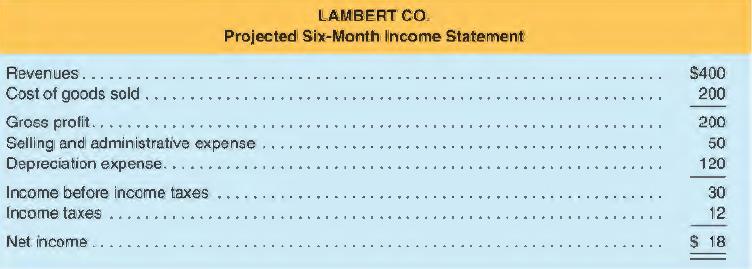

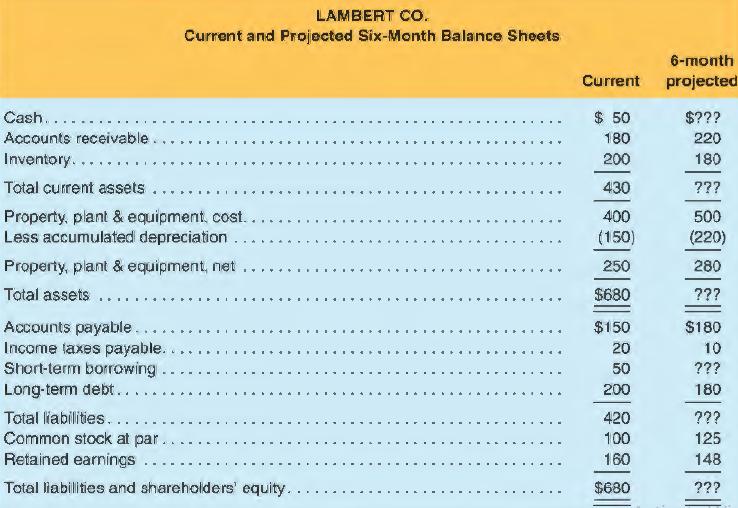

The president and CFO of Lambert Co. will be meeting with their bankers next week to discuss the short-term financing needs of the company for the next six months. Lambert's controller has provided a projected income statement for the next six-month period, and a current balance sheet along with a projected balance sheet for the end of that six-month period. These statements are presented below($ millions).

Additional Information (already reflected in the projected income statement and balance sheet): Lambert's current long-term debt includes $100 that is due within the next six months. During the next six months, the company plans to take advantage of lower interest rates by issuing new long-term debt that will provide $80 in cash proceeds. During the next six months, the company plans to dispose of equipment with an original cost of $125 and accumulated depreciation of $50. An appraisal by an equipment broker indicates that Lambert should be able to get $75 in cash for the equipment. In addition, Lambert plans to acquire new equipment at a cost of $225.

• A small issue of common stock for cash ($25) and a cash dividend to shareholders ($30) are planned in the next six months.

• Lambert's outstanding long-term debt imposes a restrictive loan covenant on the company that requires Lambert to maintain a debt-to-equity ratio below 1.75.

REQUIRED

The CFO says, " I would like a clear estimate of the amount of short-term borrowing that we will need six months from now. I want you to prepare a forecasted statement of cash flows that we can take to the meeting next week."

Prepare the required statement of cash flows, using the indirect method to compute cash flow from operating activities. The forecasted statement should include the needed amount of short-term borrowing and should be consistent with the projected balance sheet and income statement, as well as the loan covenant restriction.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman