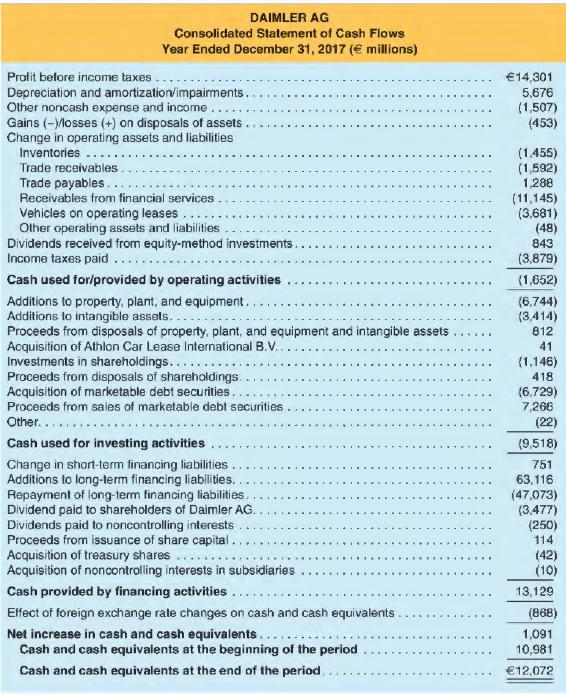

The statement of cash flows for Daimler AG follows: REQUIRED: a. Daimler begins its cash flow statement

Question:

The statement of cash flows for Daimler AG follows:

REQUIRED:

a. Daimler begins its cash flow statement with before-tax income of €14,301 million, then adds €5,676 million for depreciation and amortization. Why is Daimler adding depreciation and amortization to net income in this computation?

b. Why does Daimler subtract €453 million of gains on disposals of assets in its indirect method cash flows from operating activities? If these gains are all created by disposals of property, plant, and equipment and intangible assets, what was the book value of the assets Daimler disposed of during fiscal year 2017?

c. Daimler shows a negative€ 1,455 million for inventories in the statement of cash flows. Does this mean that Daimler paid €1,455 million for inventories in 2017? Explain.

d. Compute Daimler's free cash flow for 2017. How did the company finance its investing activities?

e. Daimler reports a net cash outflow from operating activities of€ 1,652 million, despite reporting pre-tax income of €14,301 million. What principal activities account for this difference? Does this raise concerns about the health of Daimler AG?

f. Why does Daimler list the "effect of foreign exchange rate changes on cash and cash equivalents" in its statement of cash flows? What does this amount represent?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman