United Continental Holdings, Inc., did not adopt the new lease standard in 2018 but provides the following

Question:

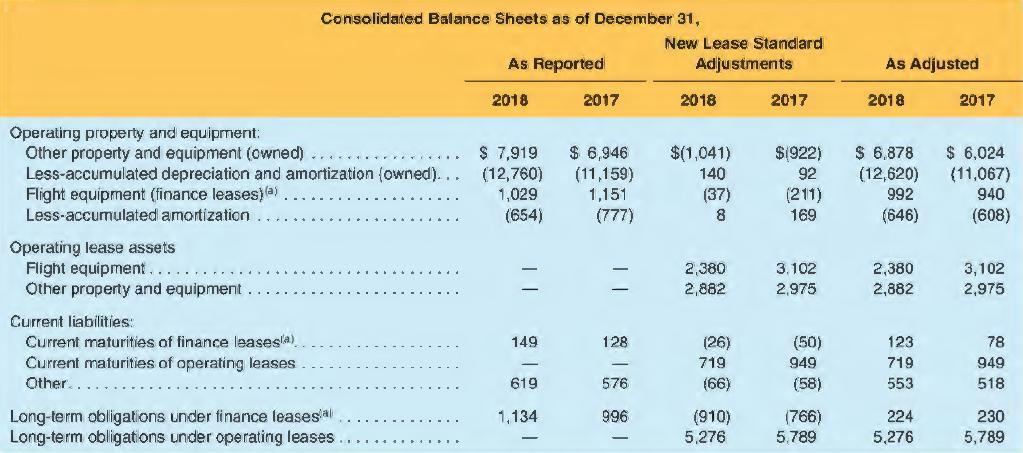

United Continental Holdings, Inc., did not adopt the new lease standard in 2018 but provides the following disclosure its 2018 10-K report($ millions).

The adoption of the New Lease Standard primarily resulted in the recording of assets and obligations of our operating leases on our consolidated balance sheets. Certain amounts recorded for prepaid and accrued rent associated with historical operating leases were reclassified to the newly captioned Operating lease assets in the consolidated balance sheets. Also, certain leases designated under Topic 840 as owned assets and capitalized finance leases will not be considered assets under the New Lease Standard and will be removed from the consolidated balance sheets, along with the related capital lease liability.

a. What is the amount United discloses that it would have capitalized for operating leases as right-of-use lease assets for the year ended December 31, 2018?

b. What is the amount of additional liability United discloses that it would have recorded for operating leases had United adopted the new lease standard in 2018?

c. What is the amount of asset under the new lease standard for finance leases? For the lease liability related to finance leases?

d. Why do you think the amount of operating leases is so much greater than finance leases?

e. United reported total assets of $44,792 million, total liabilities of $34,797 million, and total shareholders' equity of $9,995 million. Net income for the year was reported as $2,129 for the year and is essentially unchanged as a result of the new lease standard. Compute the reported return-on-assets and debt-to-equity ratios. Compute the ratios adjusted for the new lease standard, only taking into account the changes for operating leases (ignore all other changes).

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman