Wheel Place Company began operations on March 1, 2019, to provide automotive wheel alignment and balancing services.

Question:

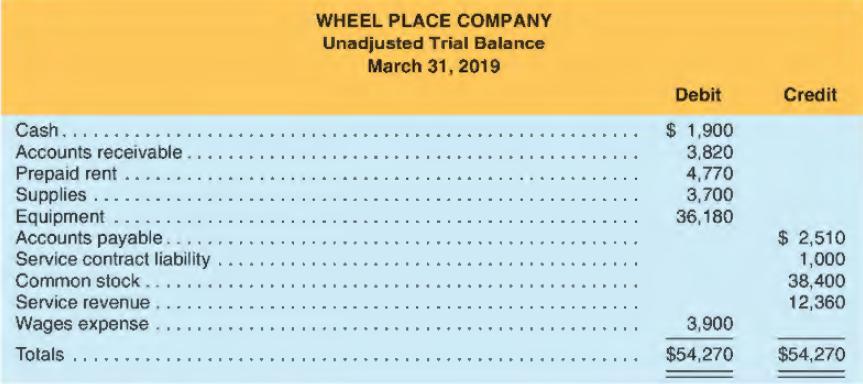

Wheel Place Company began operations on March 1, 2019, to provide automotive wheel alignment and balancing services. On March 31, 2019, the unadjusted balances of the firm's accounts are as follows.

The following information is available.

1. The balance in Prepaid Rent was the amount paid on March I to cover the first 6 months' rent.

2. Supplies available on March 31 amount to $1,720.

3. Equipment has an estimated life of nine years and a zero salvage value.

4. Unpaid and unrecorded wages at March 31 were $560.

5. Utility services used during March were estimated at $390; a bill is expected early in April.

6. The balance in Service Contract Liability was the amount received on March 1 from a car dealer to cover alignment and balancing services on cars sold by the dealer in March and April. The Wheel Place agreed to provide the services at a fixed fee of $500 each month.

REQUIRED:

a. Prepare its adjusting entries at March 31, 2019, (1) using the financial statement effects template, and (2) in journal entry form.

b. Set up T-accounts, enter the balances above, and post the adjusting entries to them.

c. Prepare its income statement for March and its balance sheet at March 31, 2019.

d. Prepare entries to close its temporary accounts in journal entry form and post the closing entries to the T-accounts.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman