Refer to the sensitivity analysis of Husky Energy Inc. reproduced in Table 7.2. The analysis discloses the

Question:

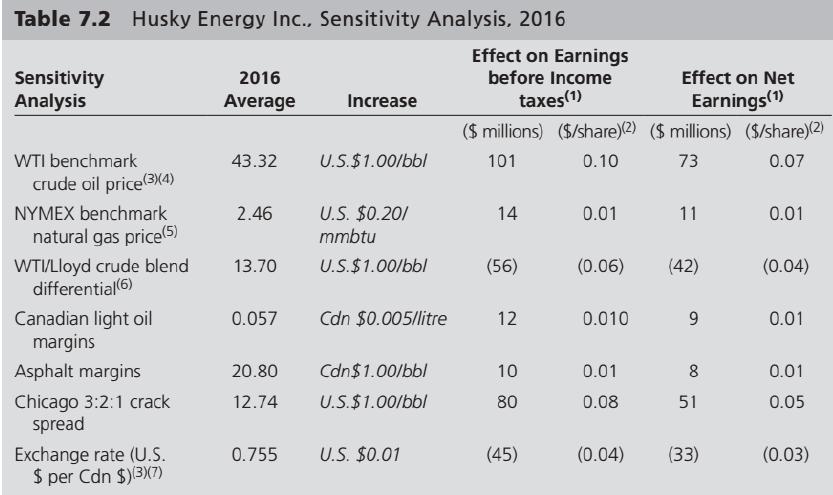

Refer to the sensitivity analysis of Husky Energy Inc. reproduced in Table 7.2. The analysis discloses the potential effects of changes in prices of oil and natural gas, and of changes in the CON/U.S. dollar exchange rate, on 2016 cash flows and earnings.

Required

a. Evaluate the relevance and re liability of t his method of disclosing risk information.

b . The analysis indicates that the sensitivity of earnings to its oil and natural gas activities is before fair value gains and losses [Table 7 .2, Notes (1) and (3)]. Presumably, this is because price risks relating to these activities are effectively hedged. As an investor, would you find sensitivity information net of hedging, or before hedging, more useful? Explain.

c. Price risks arise from changes in the market prices of crude oil and natural gas, with associated foreign exchange risk because market prices are largely based on the U.S. dollar. Boards of directors of some companies limit hedging of future oil and gas price changes to only a portion of production or, at least, monitor the extent of hedging closely. That is, all production is not hedged. Why do boards impose such limitations on management's ability to manage risk? Give reasons based on corporate governance, cost, and investor diversification considerations.

Step by Step Answer:

Financial Accounting Theory

ISBN: 9780134166681

8th Edition

Authors: William R. Scott, Patricia O'Brien