The Coca-Cola Company and PepsiCo, Inc. provide refreshments to every corner of the world. Selected data from

Question:

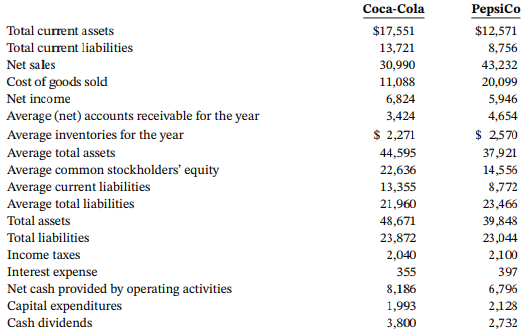

The Coca-Cola Company and PepsiCo, Inc. provide refreshments to every corner of the world. Selected data from hypothetical consolidated financial statements for The Coca-Cola Company and for PepsiCo, Inc. are presented here (in millions).

a. Compute the following liquidity ratios for Coca-Cola and for PepsiCo and comment on the relative liquidity of the two competitors.

1. Current ratio.

2. Accounts receivable turnover.

3. Average collection period.

4. Inventory turnover.

5. Days in inventory.

b. Compute the following solvency ratios for the two companies and comment on the relative solvency of the two competitors.

1. Debt to assets ratio.

2. Times interest earned.

3. Free cash flow.

c. Compute the following profitability ratios for the two companies and comment on the relative profitability of the two competitors.

1. Profit margin.

2. Asset turnover.

3. Return on assets.

4. Return on common stockholders’ equity.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1119493631

9th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso