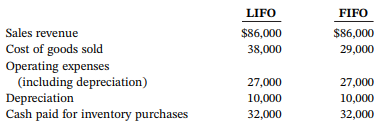

The following comparative information is available for Rose Company for 2022. Instructions a. Determine net income under

Question:

The following comparative information is available for Rose Company for 2022.

Instructions

a. Determine net income under each approach. Assume a 30% tax rate.

b. Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis.

c. Calculate the quality of earnings ratio under each approach and explain your findings.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Tools for Business Decision Making

ISBN: 978-1119493631

9th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted: