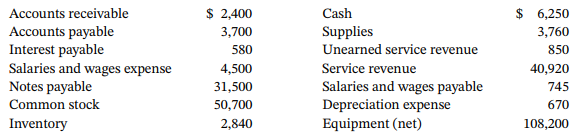

The following information is available for Randall Inc. Instructions Using the information above, prepare a balance sheet

Question:

The following information is available for Randall Inc.

Instructions

Using the information above, prepare a balance sheet as of December 31, 2022. (Hint: Solve for the missing retained earnings amount.)

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Tools for Business Decision Making

ISBN: 978-1119493631

9th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted: