You are a loan officer for White Sands Bank of Taos. Paul Jason, president of P. Jason

Question:

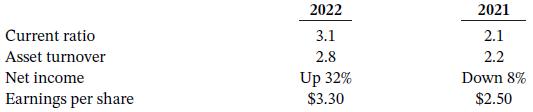

You are a loan officer for White Sands Bank of Taos. Paul Jason, president of P. Jason Corporation, has just left your office. He is interested in an 8-year loan to expand the company’s operations. The borrowed funds would be used to purchase new equipment. As evidence of the company’s debt worthiness, Jason provided you with the following facts.

Jason is a very insistent (some would say pushy) man. When you told him that you would need additional information before making your decision, he acted off ended and said, “What more could you possibly want to know?” You responded that, at a minimum, you would need complete, audited financial statements.

Instructions

With the class divided into groups, answer the following.

a. Explain why you would want the financial statements to be audited.

b. Discuss the implications of the ratios provided for the lending decision you are to make. That is, does the information paint a favorable picture? Are these ratios relevant to the decision?

c. List three other ratios that you would want to calculate for this company, and explain why you would use each.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1119493631

9th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso