Question:

Baker Variety Store had the following balances as of November 1:

Accounts Receivable ................................... $10,100

Allowance for Uncollectible Accounts ........... $760

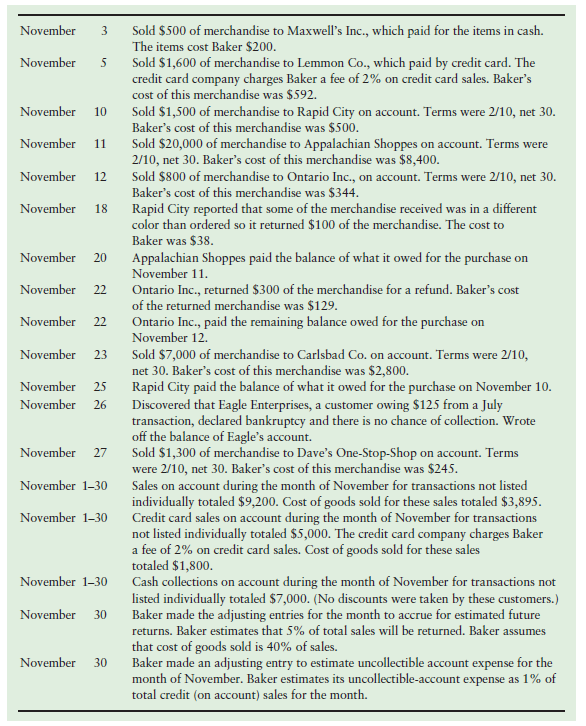

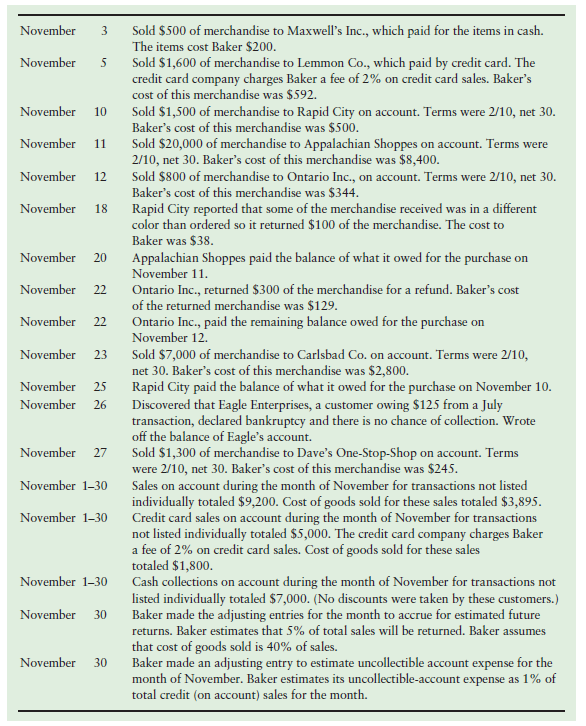

The following selected transactions occurred at Baker Variety Store during the month of November:

Requirements

1. Record Baker’s November transactions, including the cost of goods sold entries for each sale.

2. Calculate the net realizable value of accounts receivable as of November 30.

Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Transcribed Image Text:

November Sold $500 of merchandise to Maxwell's Inc., which paid for the items in cash. The items cost Baker $200. 3 November Sold $1,600 of merchandise to Lemmon Co., which paid by credit card. The credit card company charges Baker a fee of 2% on credit card sales. Baker's cost of this merchandise was $592. Sold $1,500 of merchandise to Rapid City on account. Terms were 2/10, net 30. Baker's cost of this merchandise was $500. November 10 November Sold $20,000 of merchandise to Appalachian Shoppes on account. Terms were 2/10, net 30. Baker's cost of this merchandise was $8,400. 11 November Sold $800 of merchandise to Ontario Inc., on account. Terms were 2/10, net 30. Baker's cost of this merchandise was $344. 12 November Rapid City reported that some of the merchandise received was in a different color than ordered so it returned $100 of the merchandise. The cost to Baker was $38. 18 November Appalachian Shoppes paid the balance of what it owed for the purchase on November 11. 20 November 22 Ontario Inc., returned $300 of the merchandise for a refund. Baker's cost of the returned merchandise was $129. Ontario Inc., paid the remaining balance owed for the purchase on November 12. November 22 November 23 Sold $7,000 of merchandise to Carlsbad Co. on account. Terms were 2/10, net 30. Baker's cost of this merchandise was $2,800. Rapid City paid the balance of what it owed for the purchase on November 10. Discovered that Eagle Enterprises, a customer owing $125 from a July transaction, declared bankruptcy and there is no chance of collection. Wrote off the balance of Eagle's account. Sold $1,300 of merchandise to Dave's One-Stop-Shop on account. Terms were 2/10, net 30. Baker's cost of this merchandise was $245. Sales on account during the month of November for transactions not listed individually totaled $9,200. Cost of goods sold for these sales totaled $3,895. Credit card sales on account during the month of November for transactions not listed individually totaled $5,000. The credit card company charges Baker a fee of 2% on credit card sales. Cost of goods sold for these sales totaled $1,800. Cash collections on account during the month of November for transactions not listed individually totaled $7,000. (No discounts were taken by these customers.) Baker made the adjusting entries for the month to accrue for estimated future returns. Baker estimates that 5% of total sales will be returned. Baker assumes November 25 November 26 November 27 November 1-30 November 1-30 November 1-30 November 30 that cost of goods sold is 40% of sales. Baker made an adjusting entry to estimate uncollectible account expense for the month of November. Baker estimates its uncollectible-account expense as 1% of total credit (on account) sales for the month. November 30