Cabelas Incorporated (CAB) is a leading specialty retailer of outdoor sports merchandise. Dicks Sporting Goods, Inc. (DKS)

Question:

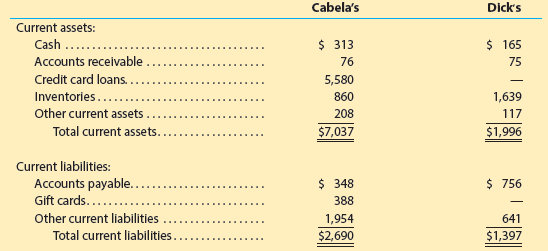

Cabela€™s has a branded credit card that is the basis for its financial services business. €œCredit card loans€ in Cabela€™s current assets represent the amounts due from Cabela€™s CLUB® Visa credit card customers. The credit card loans represent 2,064,517 active accounts with an average balance of $2,480. The credit card holders have a median FICO score of 793, which denotes highly creditworthy customers. Cabela€™s other current liabilities include, among other items, short-term funding to support credit card purchases from its CLUB members.

a. What do the €œgift cards€ listed under Cabela€™s current liabilities represent?

b. Should the €œcredit card loans€ be considered part of quick assets for Cabela€™s computation of the quick ratio? Explain.

c. Compute the current ratio for Cabela€™s and Dick€™s Sporting Goods. Round to one decimal place.

d. Compute the quick ratio for Cabela€™s and Dick€™s Sporting Goods. Round to one decimal place.

e. Compare the two companies using the computations in (c) and (d).

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Corporate Financial Accounting

ISBN: 9781337398169

15th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac