During January 2019, Pentagon Company purchased the following securities for its long-term investment portfolio: Square Company common

Question:

During January 2019, Pentagon Company purchased the following securities for its long-term investment portfolio:

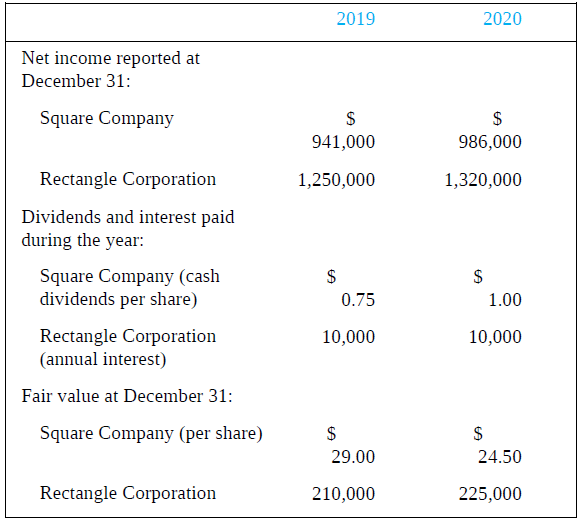

Square Company common stock: 12,000 shares (200,000 outstanding) at $25 per share

Rectangle Corporation bonds: $200,000 (10-year, 5 percent) purchased at par (not to be held to maturity or actively traded)All companies have a December 31 year-end. Subsequent to acquisition, the following data were available:

Required:

Req. 1?What accounting method should be used for the investment in Square common stock? Rectangle bonds? Why?

Req. 2 Give the journal entries for Pentagon Company for each year in parallel columns (if none, explain why) for each of the following:

a. Purchase of the investments.

b. Income reported by Square Company and Rectangle Corporation.

c. Dividends and interest received from Square Company and Rectangle Corporation.

d. Fair value effects at year-end.

Req. 3 For each year, show how the following amounts should be reported on the financial statements:

a. Long-term investments.

b. Other comprehensive income for unrealized gains/losses.

c. Revenues and gains/losses.

MaturityMaturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259964947

10th edition

Authors: Robert Libby, Patricia Libby, Frank Hodge