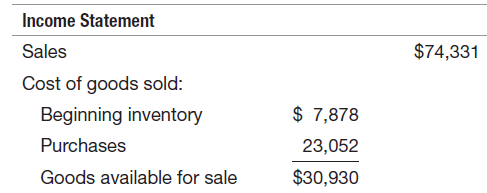

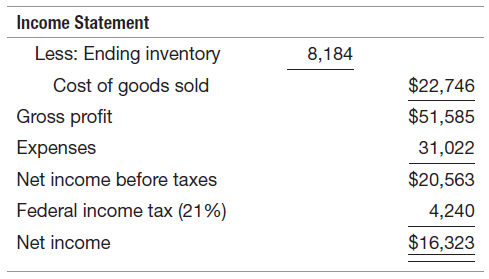

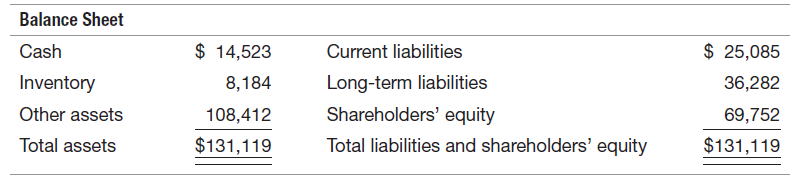

Financial statements as of December 31, 2014, for Johnson & Johnson are as follows. The company used

Question:

Assume that on December 30, 2014, Johnson & Johnson decided to change from the FIFO to the LIFO inventory cost flow assumption. Assume that the ending inventory value under the LIFO assumption is $7,000.

REQUIRED:

a. Compute the change in Johnson & Johnson€™s current ratio associated with the change from FIFO to LIFO. Round to two decimal places.

b. Compute the change in Johnson & Johnson€™s gross profit and net income associated with the change from FIFO to LIFO. Assume that the dollar amount of the change is reflected in cost of goods sold.

c. How many tax dollars would be saved by the change from FIFO to LIFO?

d. Discuss some of the disadvantages associated with the change to LIFO.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: