For 2018 and 2017, calculate return on sales, asset turnover, return on assets (ROA), leverage, return on

Question:

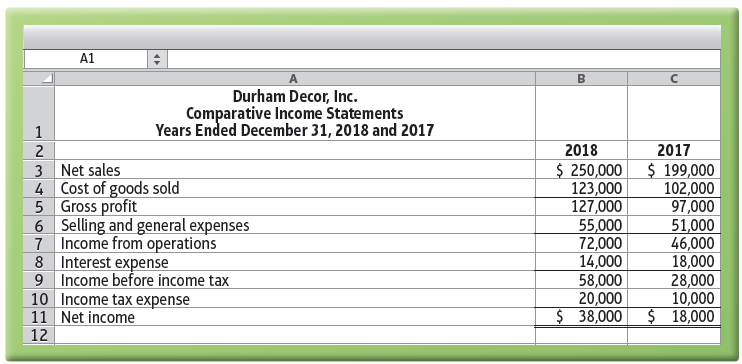

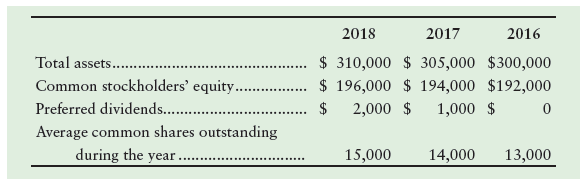

For 2018 and 2017, calculate return on sales, asset turnover, return on assets (ROA), leverage, return on common stockholders’ equity (ROE), gross profit percentage, operating income percentage, and earnings per share to measure the ability to earn profits for Durham Decor, Inc., whose comparative income statements follow. Perform a DuPont Analysis for ROA and ROE, and round each component ratio to three decimal places; for other ratio computations, round to two decimal places.

Additional data:

Did the company’s operating performance improve or deteriorate during 2018?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: