Hadera Company prepared its annual financial statements dated December 31 of the current year. The company applies

Question:

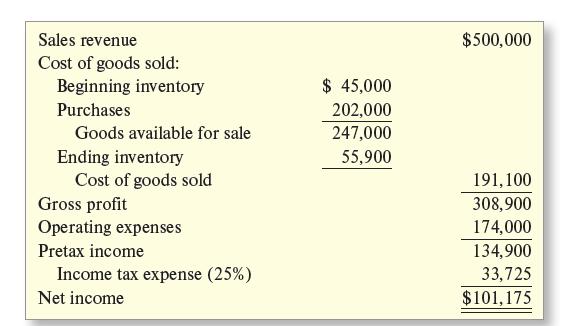

Hadera Company prepared its annual financial statements dated December 31 of the current year. The company applies the FIFO inventory costing method; however, the company neglected to apply lower of cost or net realizable value to the ending inventory. The preliminary current year income statement follows:

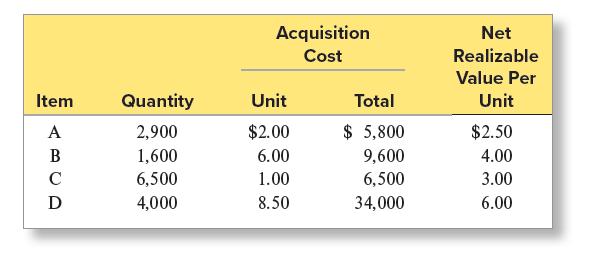

Assume that you have been asked to restate the current year financial statements to incorporate lower of cost or NRV. You have developed the following data relating to the current year ending inventory:

Required:

1. Restate the income statement to reflect lower of cost or net realizable value valuation of the current year ending inventory. Apply lower of cost or NRV on an item-by-item basis and show computations.

2. Compare and explain the lower of cost or net realizable value effect on each amount that was changed on the income statement in requirement (1).

3. What is the conceptual basis for applying lower of cost or net realizable value to merchandise inventories?

4. Thought question: What effect did lower of cost or net realizable value have on the current year cash flow? What will be the long-term effect on cash flow?

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge