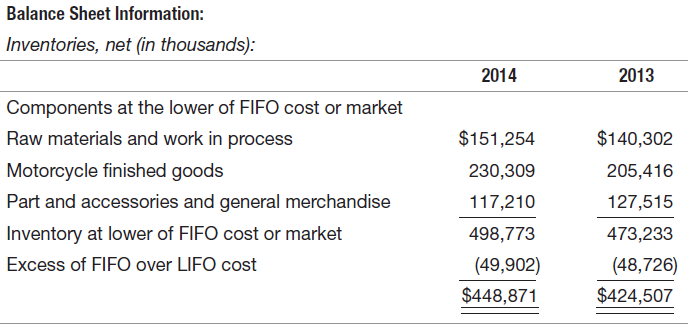

Harley-Davidson manufactures motorcycles and accessories. Financial information from the 2014 annual report is excerpted as follows: Inventory

Question:

Inventory obsolescence reserves deducted from FIFO cost were $17.8 million and $17.5 million as of December 31, 2014 and 2013, respectively.

Inventory obsolescence reserves deducted from FIFO cost were $17.8 million and $17.5 million as of December 31, 2014 and 2013, respectively.REQUIRED:

a. Why would a potential investor or creditor who is considering investing in Harley-Davidson be interested in the difference between LIFO and FIFO inventory values?

b. Explain why obsolete inventory is deducted from the carrying value of the asset.

c. Harley-Davidson€™s effective tax rate is 34.2 percent. Approximately how much more income tax would the company have paid if at the end of 2014 it switched to FIFO?

d. Discuss why Harley-Davidson might resist adopting IFRS.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: