Lundy Manufacturing produces and sells football equipment. The company was involved in the following transactions or events

Question:

1. The company purchased $250,000 worth of materials to be used during 2019 to manufacture helmets and shoulder pads.

2. The company sold football equipment for $500,000. The inventory associated with the sale cost the company $375,000.

3. One of the company€™s plants in San Francisco was damaged by a minor earthquake. The total amount of the damage was $100,000.

4. The company issued ten ($1,000 face value) bonds at a discount (0.98).

5. The company incurred $143,000 in wage expenses.

6. The company was sued by a high school football player who was injured while using some of the company€™s equipment. The football player will probably win the suit, and the amount of the settlement has been estimated at $10,000. This is the sixth lawsuit filed against the company in the past three years.

7. The company switched from the double-declining-balance depreciation method to the straight-line depreciation method.

8. The company declared and paid $50,000 in dividends.

9. The company incurred a loss when it sold some securities that it was holding as an investment.

REQUIRED:

a. Classify each of these transactions as financing, investing, or operating.

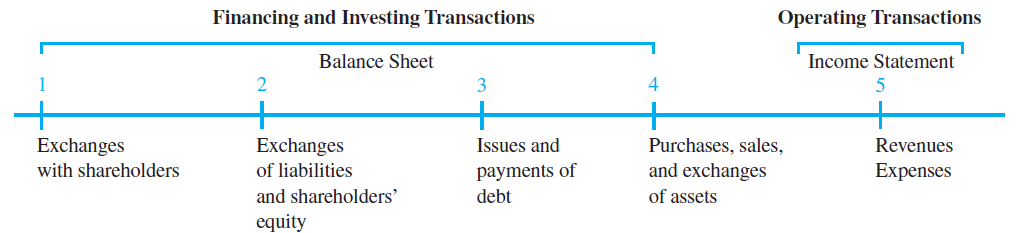

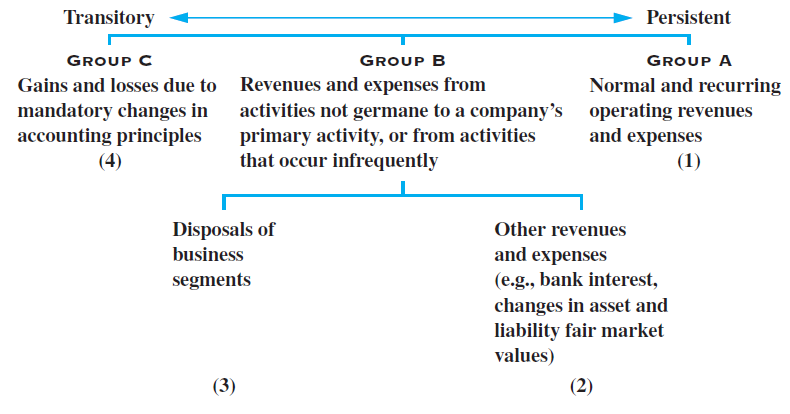

b. Refer to Figures 13€“2 and 13€“3 in the text, and identify the category in which each of the items listed should be placed.

c. Which of these items should be included on the company€™s income statement? Briefly describe how they should be disclosed.

Figure 13-2

Figure 13-3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: