Mackey Company acquired equipment on January 1, 2017, through a leasing agreement that required an annual year-end

Question:

REQUIRED:

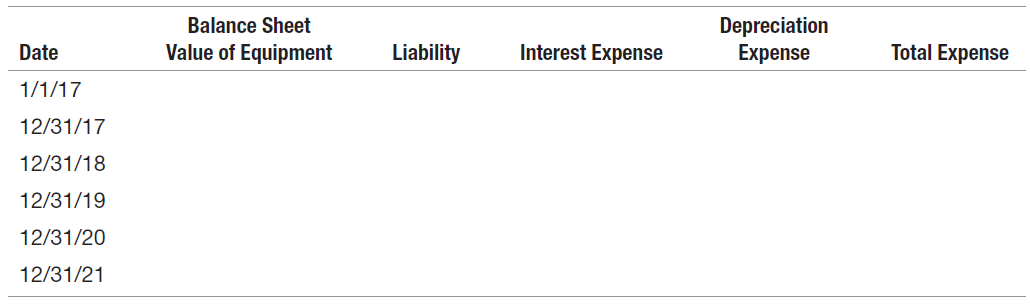

a. Compute the amounts that would complete the table:

b. Compute rent expense for 2017€“2021 if the lease is treated as an operating lease.

c. Compute total expense over the five-year period under the two methods and comment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: