Mammoth Enterprises purchased 50 percent of the outstanding stock of Atom Inc. on December 31 for $60,000

Question:

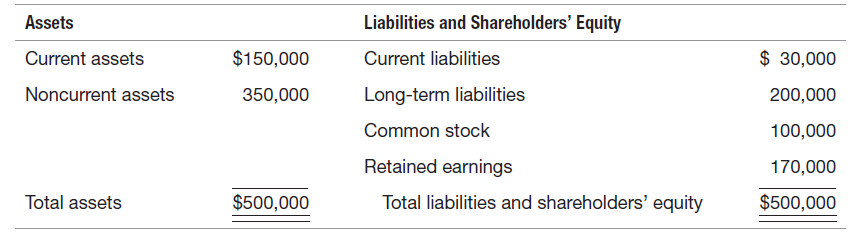

Mammoth entered into a debt covenant earlier in the year that requires the company to maintain a debt/ equity ratio of less than 1:1.

REQUIRED:

a. Compute Mammoth€™s debt/equity ratio both before and after the acquisition. Consider non-controlling a liability. Do a consolidation even though Mammoth only purchased 50 percent of the steel.

b. Explain why in this situation Mammoth would probably prefer the equity method instead of treating this transaction as a purchase and preparing consolidated financial statements.

Transcribed Image Text:

Liabilities and Shareholders' Equity Current liabilities Assets Current assets $ 30,000 $150,000 Long-term liabilities Common stock Retained earnings Total liabilities and shareholders' equity Noncurrent assets 350,000 200,000 100,000 170,000 Total assets $500,000 $500,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

a DebtEquity Ratio Total Liabilities Total Shareholders Equity Prior to the acquisition of Atom Inc Mammoths total liabilities were 230000 30000 curre...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Mammoth Enterprises purchased 50 percent of the outstanding stock of Atom, Inc. on December 31 for $60,000 cash. On that date, the book value of Atom's net assets was $70,000. The market value of...

-

In 2009 Yoda Company purchased all of the outstanding stock of SOLO Company at book value. Yoda accounts for its purchase of SOLO using initial value and SOLO does not pay any dividends. On January 1...

-

3.7.) 37 1) Are f(x)=x-2 & glx = x-2 hverses? 2) given4y+2X=12 find 2.) given the inverse for the functies of f 2) the Inverse for the function of X for extra prachter To H & onto for both fuochons

-

If a charge on the body is InC, then how many electrons are present on the body? (a) 1.6 10-19 (c) 6.25 10 (b) 6.25 x 101 (d) 6.25 x 108

-

Assume the market for cat food is perfectly competitive. The cost curves for a typical cat food producer are depicted below. Indicate whether each of the following statements is true or false and...

-

Population a. Consider the following data on immigration into four populations over 20 yr. For each, find the sample mean and the sample standard deviation. Compare them with the mathematical mean...

-

In April 2023, an article in the Economist discussed Apples plans to increase the number of iPhones manufactured in India. According to the article, Apple is scrambling to avoid having all its apples...

-

The Appraisal Department of Bonita Bank performs appraisals of business properties for loans being considered by the bank and appraisals for home buyers that are financing their purchase through some...

-

1. Which of the following is a CORRECT statement? 2. 3. (a) 2.3056+10.138-7.4671 = 4.9765 (b) 2.38 x 1.0 = 2.38 8.05 (c) -=2.6 3.1 (d) (1.11 0.1) x 9.0 = 9.0 A projectile travels at 0 below...

-

Jimmy owns a garden in which he has planted N trees in a row. After a few years, the trees have grown up and now they have different heights. Jimmy pays much attention to the aesthetics of his...

-

Gidley Inc. purchased a piece of equipment on January 1, 2017. The following information is available for this purchase: Purchase price .........................$950,000 Transportation...

-

Lowery Inc. purchased new plant equipment on January 1, 2017. The company paid $920,000 for the equipment, $62,000 for transportation of the equipment, and $10,000 for insurance on the equipment...

-

1. All homeless people who are panhandlers are destitute individuals. Therefore, all homeless people are destitute individuals. 2. Some wrestlers are colorful hulks, since some wrestlers are colorful...

-

Why did the Union prevail, and the Confederacy lose, the Civil War?

-

What is the importance of standardization of Medical Technology/Medical Laboratory Science Education among all Higher Education Institutions?

-

1. (4) A blood pressure of 110 mm Hg is measured using a cuff over the wrist which is positioned 30 cm above heart level. According to Bernoulli's equation(given below), what is the blood pressure at...

-

Explain the purpose of the following types of documents commonly used in property law and conveyancing. ? a. Title deeds b. Leases c. Mortgage documents

-

In what circumstances will div 7A of pt III ITAA36 deem a private company to pay a dividend? This is under Australian law.

-

Summary financial information for Rapture Company is as follows. Compute the amount and percentage changes in 2014 using horizontal analysis, assuming 2013 is the base year. December 31, 2013...

-

Will the prediction interval always be wider than the estimation interval for the same value of the independent variable? Briefly explain.

-

Tony began a small retailing operation on January 1, 2015. During 2015, the following transactions occurred: 1. Tony contributed $20,000 of his own money to the business. 2. $60,000 was borrowed from...

-

The December 31, 2014 balance sheet for Morrison Home Services is summarized below. During January of 2015, the following transactions were entered into: 1. Services were performed for $7,000 cash....

-

The December 31, 2014, balance sheet of Tybee Corporation is provided below (in millions). Transactions during January 2015: Paid $5 for employee wages. Collected $10 cash from customers for work...

-

The price of a car you want is $39,000 today. Its price is expected to increase by $1000 each year. You now have $23,500 in an investment account, which is earning 11% per year. How many years will...

-

Marshall's concept of external economies and diseconomies refers to: a) Changes in output resulting from changes in input levels b) The effects of production on the environment c) The benefits or...

-

The DD-AA model predicts that a permanent increase in foreign money demand will lead to an improvement in the domestic current account. True/False/Uncertain, explain and support your answer with ONE...

Study smarter with the SolutionInn App