On December 31, 2018, Herndon Corporation issues 6%, 10-year convertible bonds payable with a face value of

Question:

On December 31, 2018, Herndon Corporation issues 6%, 10-year convertible bonds payable with a face value of $1,000,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 7%. Herndon amortizes bond discounts using the effective-interest method.

Requirements

1. Use the PV function in Excel to calculate the issue price of the bonds.

2. Prepare an effective-interest method amortization table for the term of the bonds using Excel.

3. Journalize the following transactions:

a. Issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable.

b. Payment of interest and amortization of the bond discount on June 30, 2019.

c. Payment of interest and amortization of the bond discount on December 31, 2019.

d. Conversion by the bondholders on July 1, 2020, of bonds with a total face value of $400,000 into 120,000 shares of Herndon $1-par common stock.

4. Show how Herndon would report the remaining bonds payable on its balance sheet at December 31, 2020.

Requirements

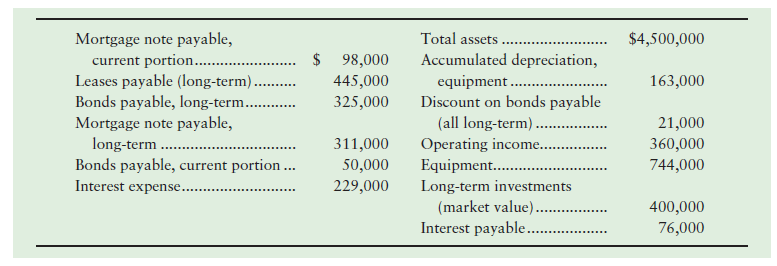

1. Show how each relevant item would be reported on the Brigham Foods classified balance sheet. Include headings and totals for current liabilities and long-term liabilities.

2. Answer the following questions about Brigham Food’s financial position at December 31, 2018:

a. What is the carrying amount of the bonds payable (combine the current and long-term amounts)?

b. Why is the interest-payable amount so much less than the amount of interest expense?

3. How many times did Brigham Foods cover its interest expense during 2018?

4. Assume that all of the existing liabilities are included in the information provided. Calculate the leverage ratio and debt ratio of the company. Use year-end figures in place of averages where needed for the purpose of calculating ratios in this problem. Evaluate the health of the company from a leverage point of view. Assume the company only has common stock issued and outstanding. What other information would be helpful in making your evaluation?

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.