On November 11, 2017, Wads worth Company purchased 20 shares of ZZZ for $8 per share. Wads

Question:

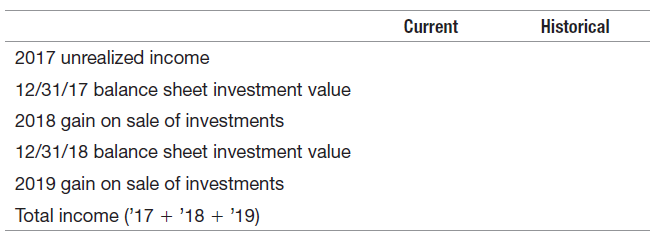

a. Complete the following chart. The first column assumes that the investment was accounted for under current accounting rules and the second under historical cost rules.

b. Comment on the differences.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: