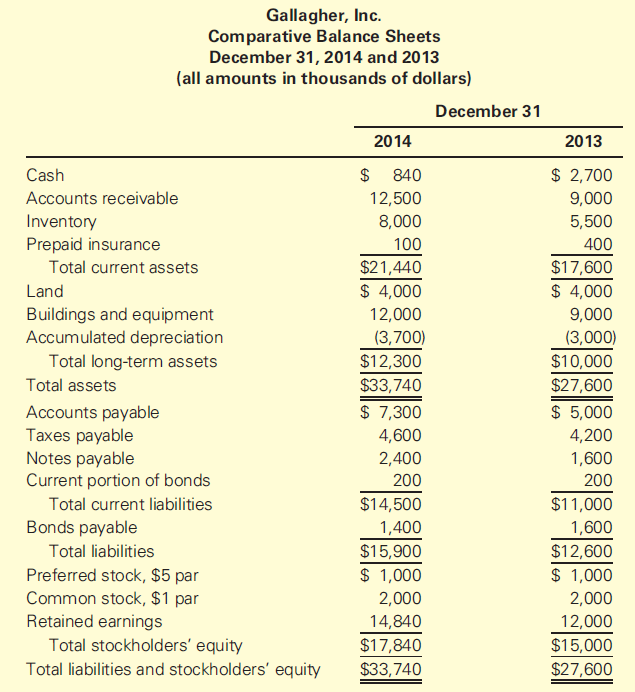

Presented here are a statement of income and retained earnings and comparative balance sheets for Gallagher, Inc.,

Question:

Gallagher, Inc.

Statement of Income and Retained Earnings

For the Year Ended December 31, 2014

(all amounts in thousands of dollars)

Net sales .........................................................................................................$48,000

Cost of goods sold ...........................................................................................36,000

Gross profit .....................................................................................................$12,000

Selling, general, and administrative expense .................................................6,000

Operating income ............................................................................................$ 6,000

Interest expense .....................................................................................................280

Income before tax .............................................................................................$ 5,720

Income tax expense .............................................................................................2,280

Net income .........................................................................................................$ 3,440

Preferred dividends .................................................................................................100

Income available to common ...........................................................................$ 3,340

Common dividends ..................................................................................................500

To retained earnings ...........................................................................................$ 2,840

Retained earnings, 1/1 .........................................................................................12,000

Retained earnings, 12/31 ...................................................................................$14,840

Required

1. Prepare a statement of cash flows for Gallagher, Inc., for the year ended December 31, 2014, using the indirect method in the Operating Activities section of the statement.

2. Gallagher€™s management is concerned with its short-term liquidity and its solvency over the long run. To help management evaluate these, compute the following ratios, rounding all answers to the nearest one-tenth of a percent:

a. Current ratio

b. Acid-test ratio

c. Cash flow from operations to current liabilities ratio

d. Accounts receivable turnover ratio

e. Number of days€™ sales in receivables

f. Inventory turnover ratio

g. Number of days€™ sales in inventory

h. Debt-to-equity ratio

i. Debt service coverage ratio

j. Cash flow from operations to capital expenditures ratio

3. Comment on Gallagher€™s liquidity and its solvency. What additional information do you need to fully evaluate the company?

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial...

Step by Step Answer:

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton