Taylor Corporation is contemplating issuing bonds to raise cash to finance an expansion. Before issuing the debt,

Question:

REQUIRED:

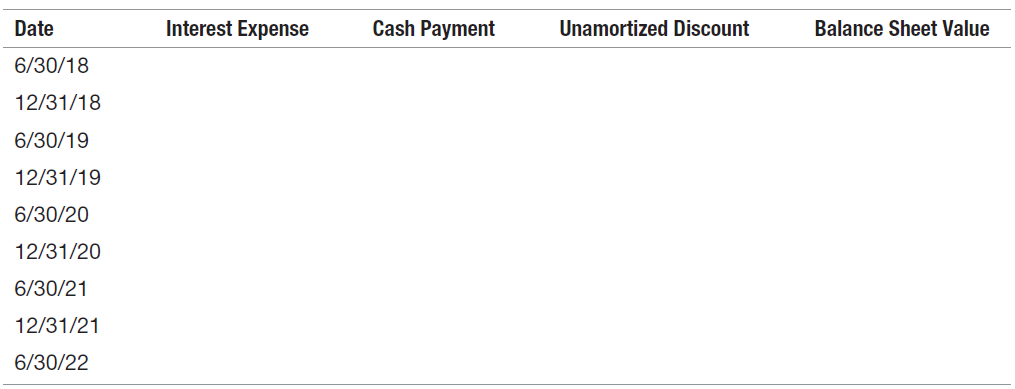

a. Compute the amounts that would complete the following table with respect to the bond issuance being considered by Taylor:

b. Find the difference between the total cash inflow from issuing the bonds and the total cash outflows from interest and principal payments.

b. Find the difference between the total cash inflow from issuing the bonds and the total cash outflows from interest and principal payments.

c. Recognizing that cash interest payments are tax deductible and assuming a tax rate of 34 percent, recompute the difference you found in (b).

d. Repeat (c), but now consider the time value of money by using the effective rate of these bonds to compute the present value of the net future cash outflows due to interest and principal payments.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: