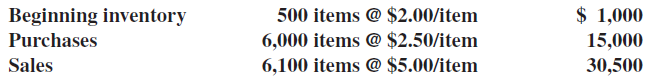

The 2017 inventory activity for Helio Brothers, a discount retailer that prepares financial statements under IFRS using

Question:

Many of the items in the company€™s inventory at the end of 2017 were judged to be outdated, and on average the market value of the remaining inventory was estimated at $1.50 per item.

REQUIRED:

a. Compute Helio€™s ending inventory and net income for 2017.

b. Early in 2018 styles appeared to change, and the average market price of the inventory written down at the end of 2017 rebounded to $2.80 per item. Record the entry made by Helio to recognize the inventory recovery. What entry would Helio record if it used U.S. GAAP instead of IFRS?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: