The accounting records of Boston Home Store show these data (in millions): The shareholders are very happy

Question:

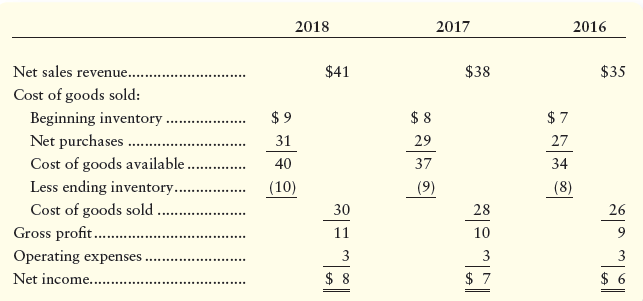

The accounting records of Boston Home Store show these data (in millions):

The shareholders are very happy with Boston’s steady increase in net income. However, auditors discovered that the ending inventory for 2016 was understated by $6 million and that the ending inventory for 2017 was understated by $7 million. The ending inventory at December 31, 2018, was correct.

Requirements

1. Show corrected income statements for each of the three years.

2. How much did these assumed corrections add to or take away from Boston’s total net income over the three-year period? How did the corrections affect the trend of net income?

3. Will Boston’s shareholders still be happy with the company’s trend of net income? Explain.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.