The balance sheet of Aqua, Inc., a world leader in the design and sale of telescopic equipment,

Question:

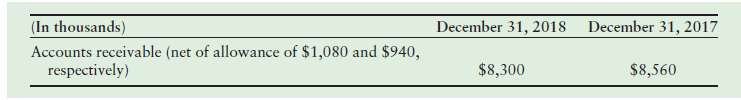

The balance sheet of Aqua, Inc., a world leader in the design and sale of telescopic equipment, reported the following information on its balance sheets for 2018 and 2017 (figures are in thousands):

In 2018, Aqua recorded $15,700 (gross) in sales (all on account), of which $700 (gross) was returned for credit. The cost of sales was $7,700; the cost of the merchandise returned was $400. Aqua offers its customers credit terms of 2/10, n/30. Ninety percent of collections on accounts receivable were made within the discount period. Aqua wrote off uncollectible accounts receivable in the amount of $120 (gross) during 2018. Sales returns are estimated to be 4% of sales.

Requirements

1. Calculate the amount of uncollectible accounts expense recorded by Aqua in 2018.

2. Calculate Aqua’s cash collections from customers in 2018.

3. Open T-accounts for Accounts Receivable and Allowance for Uncollectible Accounts. Enter the beginning balances into each of these accounts. Prepare summary journal entries to record the transactions and post the transactions to the T-accounts for the following for 2018:

a. Sales revenue

b. Cost of goods sold

c. Estimated returns inventory

d. Cost of estimated returns

e. Merchandise returned

f. Cost of merchandise returned

g. Collections

h. Write-offs of uncollectible accounts

i. Uncollectible-accounts expense

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.