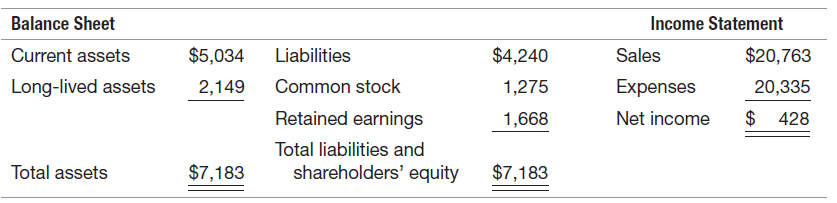

The December 31, 2014 balance sheet and the income statement for the period ending December 31 for

Question:

You are interested in purchasing Manpower and have analyzed the future prospects of the company, estimating that it should be able to maintain at least its current earnings amount for the next ten years, at which time the assets would be worthless. You also estimate that the discount rate over that time period will be 6 percent.

REQUIRED:

a. Assuming that net income is equal to cash inflows, how much should you be willing to pay for Manpower?

b. What is the book value of Manpower?

c. Explain why there is a difference between the book value of Manpower and the amount you are willing to pay for it. What assumptions and/or principles of financial accounting are important here?

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: