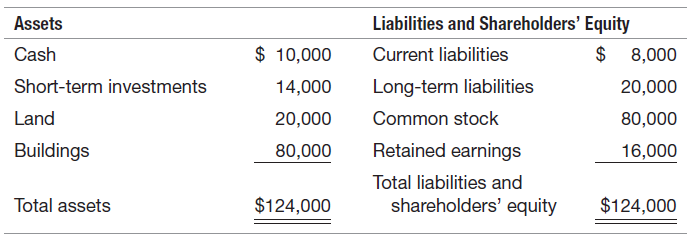

The December 31, 2017 balance sheet of Myers and Myers, prepared under generally accepted accounting principles, follows.

Question:

An investor believes that Myers and Myers can generate $20,000 cash per year for ten years, at which time it could be sold for $80,000. The FMVs of each asset as of December 31, 2017, follow:

Cash ........................................................................$ 10,000

Short-term investments ..........................................14,000

Land ...........................................................................60,000

Buildings ...................................................................40,000

Total FMV ..............................................................$124,000

REQUIRED:

a. What is the book value of Myers and Myers as of December 31, 2017?

b. What is the value of Myers and Myers as a going concern (i.e., present value of the net future cash inflows) as of December 31, 2017? Assume a discount rate of 10 percent.

c. What is the liquidation value of Myers and Myers (i.e., how much cash would Myers and Myers be able to generate if each asset were sold separately and each liability were paid off on December 31, 2017)?

d. Discuss the differences among the book value of the company, the present value, and the liquidation value. Calculate goodwill, and explain it in terms of these three valuation bases.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer: