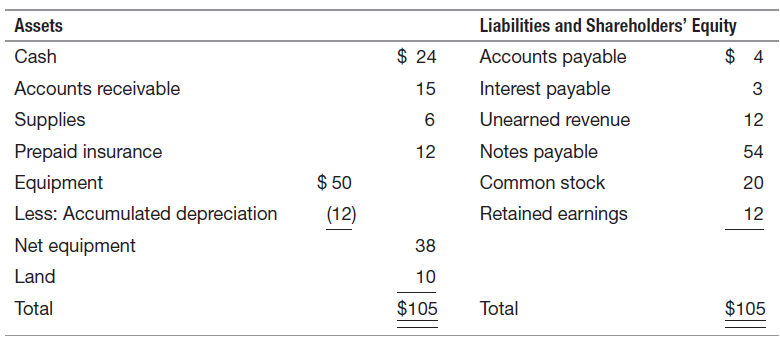

The December 31, 2017, balance sheet of Tybee Corporation is provided below (in millions). Transactions during January

Question:

Transactions during January 2018:

- Paid $5 for employee salaries and wages.

- Collected $10 cash from customers for work previously performed and billed.

- Purchased equipment for $5 cash.

- Purchased $2 of supplies for cash.

- Paid $3 to a vendor for supplies previously purchased on credit in December 2017.

- Paid the interest owed as of December 31, 2017.

- Completed $18 in services for customers, receiving 50 percent payment in cash and billing the remainder.

- Paid $15 to reduce outstanding notes payable.

- Collected $5 for the issuance of common shares.

As of 1/31/18:

- Had performed 25 percent of the services for which it had been paid in advance.

- Owes $1 for interest that will be paid next month.

- Depreciated equipment in the amount of $4.

- Physical count of supplies reveals $3 on hand.

- Declared and paid a cash dividend in the amount of 50 percent of January€™s net income.

REQUIRED:

a. Prepare the journal entries to record transactions and to adjust and close accounts.

b. Prepare a complete set of financial statements as of January 31, 2018, and prepare the statement of cash flows under the direct and the indirect (Appendix 4A) methods.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: